In a global financial system increasingly defined by ballooning debt and relentless monetary expansion, Bitcoin stands out as a unique alternative. At the heart of its appeal? A fixed supply of 21 million coins—a number that can never be changed.

This immutability gives Bitcoin a strategic edge, especially for institutional investors, family offices, and high-net-worth individuals seeking long-term wealth preservation in uncertain times.

Why Bitcoin’s Fixed Supply Matters

Scarcity That Can’t Be Printed Away

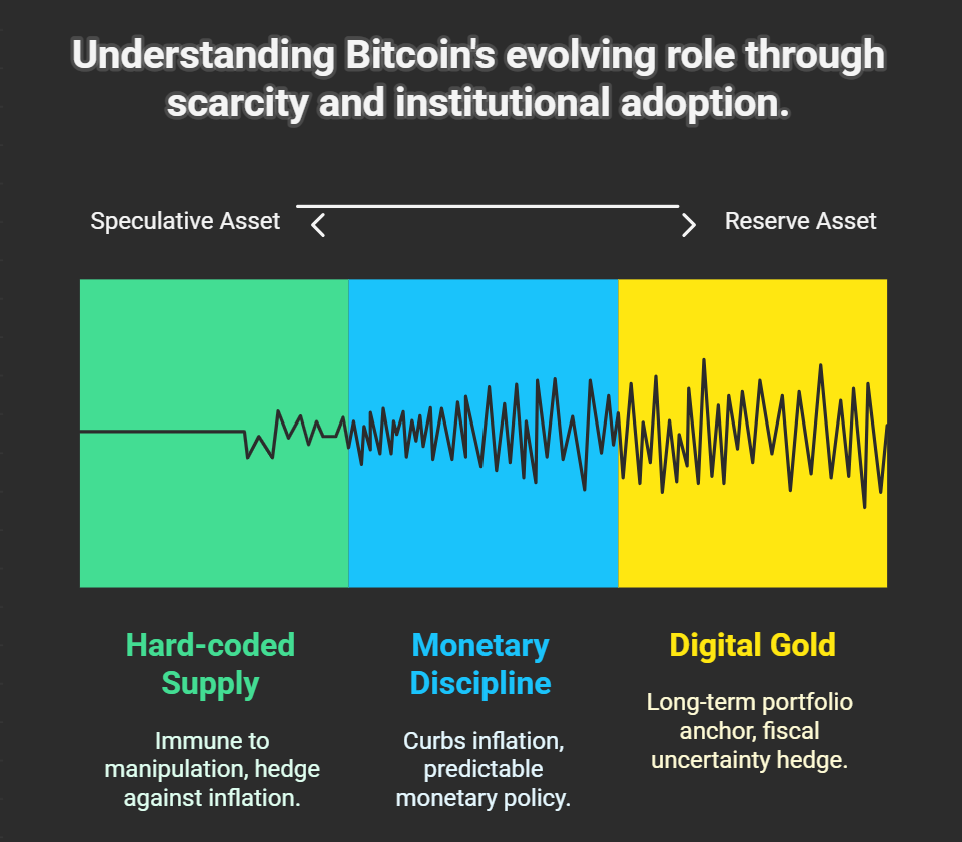

Unlike fiat currencies, which are subject to the whims of central banks and policy decisions, Bitcoin’s supply is hard-coded and immune to manipulation. This built-in scarcity offers a powerful hedge against currency debasement and inflation.

Halving Cycles Enforce Monetary Discipline

Approximately every four years, Bitcoin undergoes a “halving”—a reduction in the rate at which new coins are issued. This gradual tightening of supply curbs inflation and reinforces Bitcoin’s role as a store of value. As issuance slows, its monetary policy becomes even more predictable and disciplined.

Evolving Institutional Perspective

What was once viewed as a speculative asset is now gaining legitimacy as a reserve asset. As new issuance declines, institutional allocators are beginning to treat Bitcoin less like a trade and more like digital gold—a long-term portfolio anchor in an era of fiscal uncertainty.

In an age when traditional currencies are losing purchasing power, Bitcoin’s hard cap offers something rare: certainty. And for investors seeking to protect and preserve capital over decades, not just market cycles, that may be its most valuable feature.