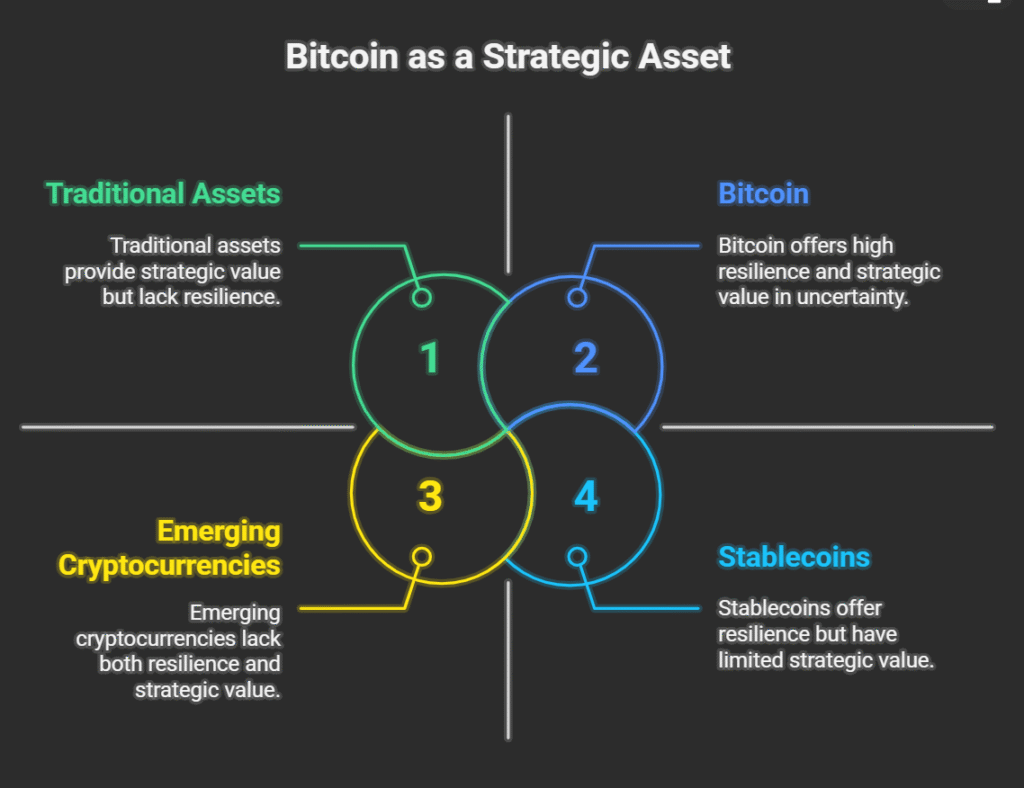

As protectionism rises and global financial systems fragment, investors are seeking assets that offer resilience, neutrality, and long-term value. In this new era, Bitcoin is emerging as a strategic tool for institutions navigating geopolitical uncertainty and fiat fragility.

Why Bitcoin Now?

Neutral by Design

Bitcoin isn’t controlled by any government or central bank. Its decentralized nature makes it uniquely resistant to capital controls, sanctions, and politicized monetary policy.

Predictable Monetary Policy

With a fixed supply and transparent issuance, Bitcoin offers a credible alternative to fiat currencies shaped by inflation and intervention.

Institutional Alignment

Family offices and institutional investors are increasingly viewing Bitcoin as a modern reserve asset—one that protects purchasing power across borders and generations.

Conclusion

In a world where money is becoming more political, Bitcoin offers something rare: autonomy. For long-term allocators, it’s not just innovation—it’s insurance.