In an era where economies are shaken by debt cycles, shifting central bank policies, and growing uncertainty, Bitcoin stands out, offering a rare form of financial predictability.

Unlike fiat currencies influenced by political agendas or central bank discretion, Bitcoin is governed by protocol: a fixed, transparent system rooted in mathematics and code. Its supply is capped at 21 million, and its issuance schedule follows a precise and unchanging rhythm. This isn’t just scarcity—it’s structure.

What Makes Bitcoin Predictable?

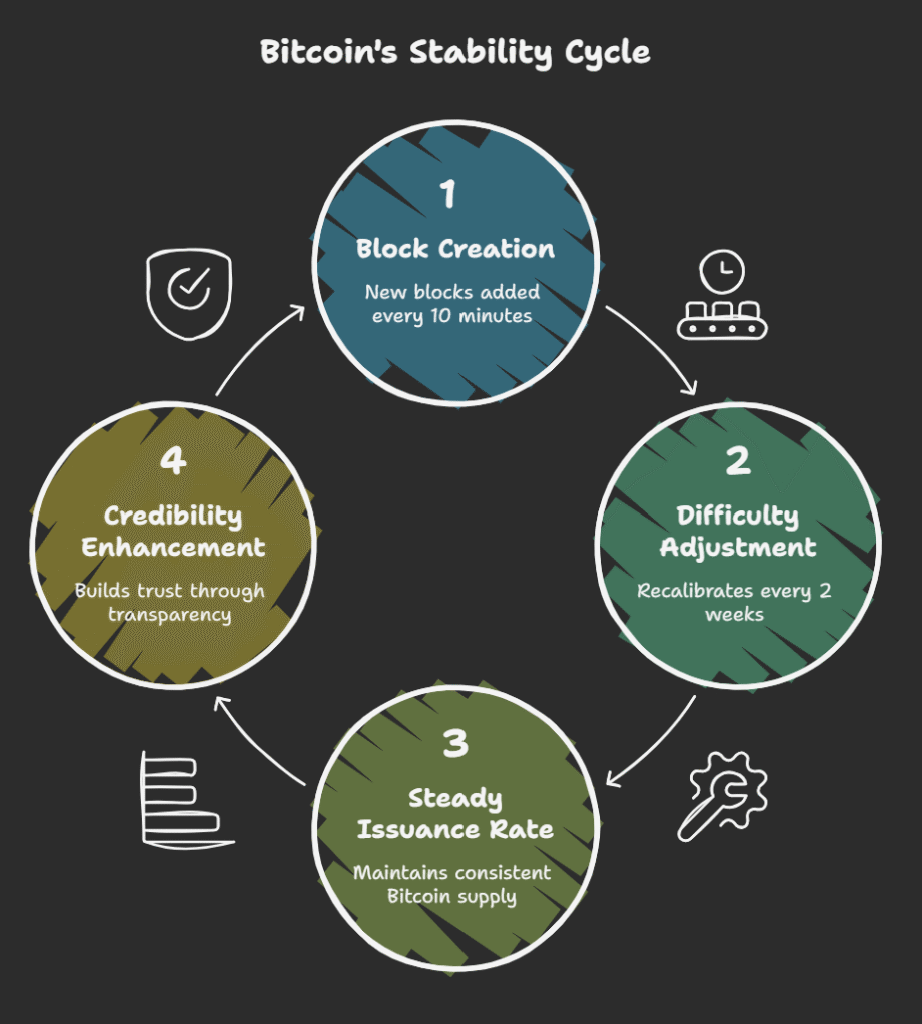

🔹 Reliable Block Time: Roughly every 10 minutes, a new block is added to the blockchain, enabling consistent, traceable settlement, immune to market sentiment or geopolitical disruptions.

🔹 Automated Difficulty Adjustment: Every 2,016 blocks (about every two weeks), the network recalibrates the mining difficulty. This ensures that, regardless of how many miners join or leave the system, Bitcoin’s issuance rate remains steady.

These core mechanisms aren’t just technical—they’re the bedrock of Bitcoin’s credibility. While traditional monetary systems adjust reactively and often opaquely, Bitcoin’s rules are auditable, politically neutral, and transparent by design.

In a financial world clouded by uncertainty, Bitcoin provides something increasingly scarce: certainty.