Across the MENA region, family offices are facing a pivotal moment. As intergenerational wealth transitions accelerate and economic landscapes become more volatile, the search for resilient, long-term strategies is gaining urgency. Amid this shift, one asset class is quietly gaining ground in high-level conversations: Bitcoin.

Once considered speculative or fringe, Bitcoin is now emerging as a strategic asset—a digital alternative to traditional stores of value, designed for a world that no longer plays by old rules.

Why Bitcoin Is Gaining Ground in MENA’s Family Office Circles

Protection from Monetary Dilution

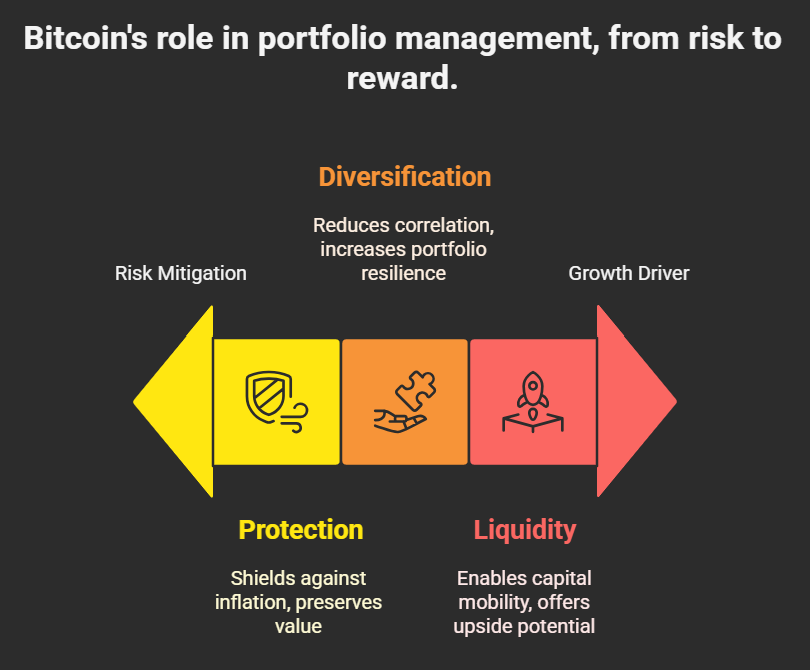

Bitcoin’s fixed supply of 21 million coins positions it as a structural hedge against inflation and the devaluation of fiat currencies. In an era when central bank policies are becoming increasingly unpredictable, this scarcity is a feature, not a flaw.

24/7 Global Liquidity Without Borders

Unlike traditional assets tied to legacy financial systems, Bitcoin operates on decentralized, borderless rails. It offers unrestricted access to capital mobility, making it an attractive option for preserving sovereign wealth.

Portfolio Diversification with a New Risk Profile

Bitcoin’s low correlation to traditional markets—such as equities, bonds, and real estate—allows it to act as a diversification tool. For multi-generational portfolios seeking resilience and asymmetrical upside, this characteristic is increasingly relevant.

The Adoption Gap: Caution, Not Rejection

Despite its rising strategic appeal, Bitcoin adoption among MENA family offices remains measured. The hesitation often centers on practical concerns: secure custody solutions, regulatory clarity, and integrating Bitcoin into long-term governance and succession plans.

But as institutional infrastructure matures—and as more high-net-worth families look beyond conventional frameworks—Bitcoin is becoming less of a “what if” and more of a “when.”

Conclusion

For MENA family offices focused on preserving wealth across generations, Bitcoin represents not just a technological innovation but a strategic imperative. In an age of macroeconomic unpredictability and rapid change, embracing this asset could be the key to unlocking long-term security and freedom.