As Bitcoin solidifies its role in institutional portfolios, the conversation has shifted. It’s no longer about whether to hold Bitcoin—it’s about how to safeguard it with infrastructure that meets the highest standards of governance, security, and operational continuity.

Enter Multi-Institution Custody (MIC): a modern custody model tailored for institutional needs. It blends Bitcoin’s decentralized ethos with the robust controls required by fiduciaries, family offices, and other sophisticated capital allocators.

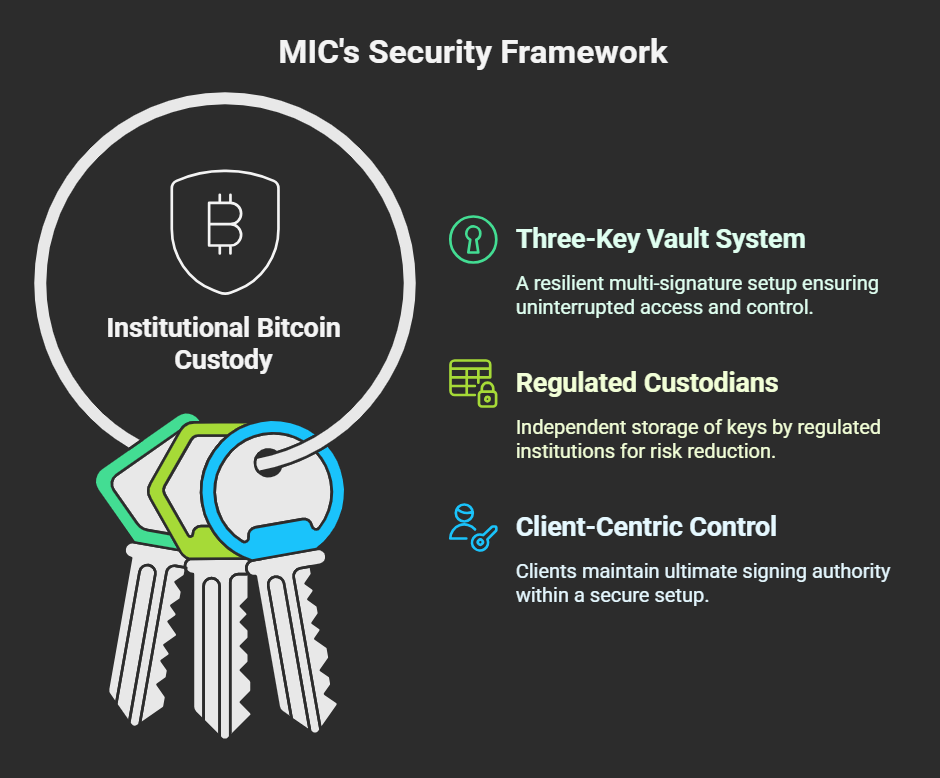

What Makes MIC a Future-Proof Custody Solution?

Three-Key Vault System

At its core is a resilient 2-of-3 multi-signature setup. This structure eliminates any single point of failure, ensuring uninterrupted access and control, even in the most extreme scenarios.

Regulated Custodians, Independently Held Keys

A different, regulated institution stores each cryptographic key. This separation reduces counterparty risk and supports jurisdictional diversification, offering stronger legal and regulatory protection.

Client-Centric Control

Clients maintain ultimate signing authority within a secure, distributed setup. This gives institutions both the sovereignty they seek and the clarity they need for smooth operations.

Why MIC Is Built for Long-Term Bitcoin Allocation

Resilient by Design

MIC’s architecture proactively defends against internal threats, cyberattacks, and organizational lapses.

Aligned with Bitcoin’s Values

Decentralized key management reflects Bitcoin’s core principle: trust minimization through distributed systems.

Preferred by Strategic Investors

MIC is increasingly the custody model of choice for high-net-worth individuals, family offices, and forward-thinking institutions aiming for secure, scalable, and regulation-ready Bitcoin exposure.