While media headlines often spotlight Bitcoin’s price swings and speculative hype, a quieter, more consequential shift is underway — one that’s reshaping the landscape of institutional investing.

In boardrooms across the globe, the conversation has evolved. It’s no longer a question of whether Bitcoin belongs in a portfolio. The questions being asked now are more strategic:

How much exposure should we allocate?

How do we custody and govern it responsibly?

Why Institutional Interest in Bitcoin Is Accelerating

Macroeconomic Hedge in a Debt-Heavy World

With rising sovereign debt and unrelenting monetary expansion, capital allocators are looking for assets that offer structural resilience. Bitcoin’s fixed supply and decentralized nature provide a rules-based counterbalance.

“It’s a hedge against irresponsibility.” — Stanley Druckenmiller

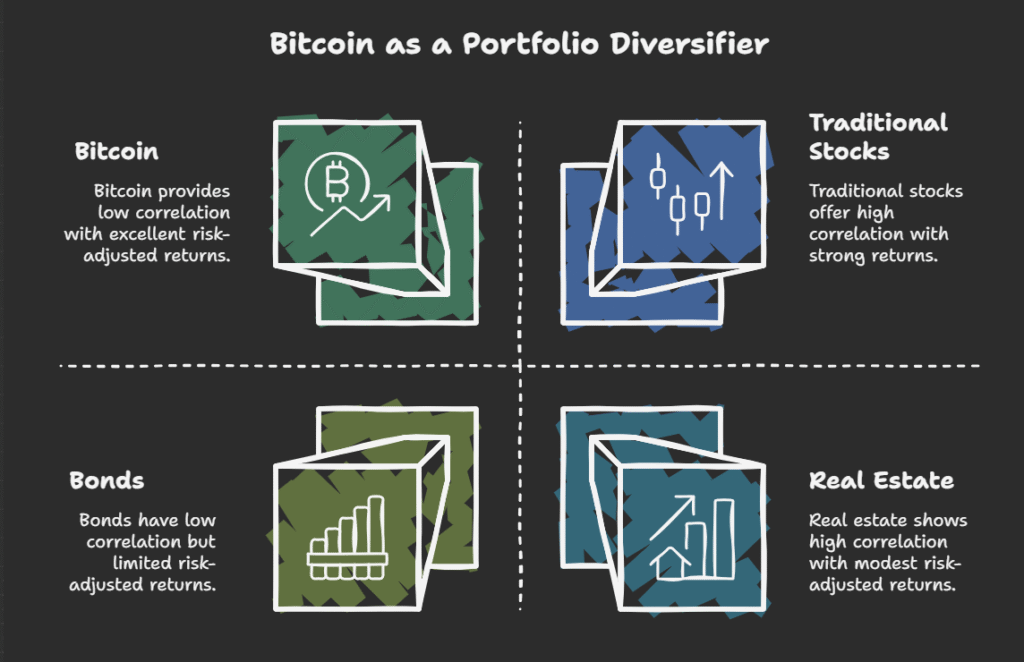

Smarter Portfolio Diversification

Bitcoin’s historically low correlation with traditional asset classes makes it an increasingly attractive diversifier. Over longer timeframes, it has enhanced risk-adjusted returns, offering asymmetric upside.

“I came to the conclusion that Bitcoin was going to be the winner of this race.” — Paul Tudor Jones

A Maturing Regulatory and Infrastructure Landscape

With the approval of spot Bitcoin ETFs and the rise of institutional-grade custody solutions, Bitcoin is no longer a fringe experiment. It’s becoming a trusted piece of the modern financial toolkit.

“Bitcoin is here to stay. We see it as part of the future of the financial system.” — Larry Fink, CEO, BlackRock