Soch rahe ho altseason aayega?

Bhai, woh toh kab ka chala gaya.

Every time Bitcoin makes a strong move, the crypto crowd starts whispering “Altseason kab aayega?” like it’s some prophecy that must come true. But this cycle? That energy is missing. Things aren’t working like they used to, and there are actual, clear reasons behind it … not just market emotions.

In this blog, we’ll break down 5 solid reasons why the classic altseason …. the one where altcoins across the board pump like crazy … might not be part of this cycle at all. No overcomplication, just simple reasoning backed by data and facts. And the last point might actually change how you look at this market going forward.

Top 5 Reasons Why Altseason Might Not Happen This Cycle

1. Bitcoin is being treated as a long-term reserve & not a trade token anymore.

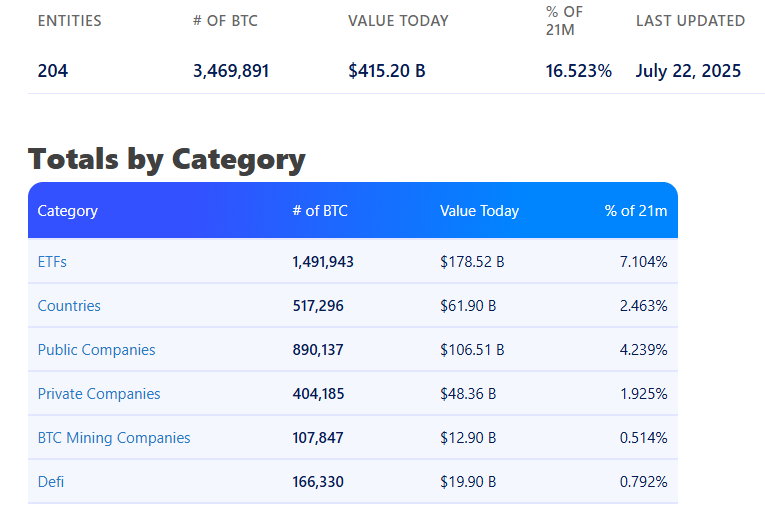

Earlier, Bitcoin was seen as just the “starter coin” … people bought it first, and then shifted to altcoins hoping for bigger profits. But now, the narrative has shifted. Big institutions, public companies like MicroStrategy, and even some governments are buying and holding Bitcoin like it’s gold. They’re not in this for a quick profit or to rotate into altcoins. They see BTC as a long-term store of value, not a stepping stone.

That means less movement from Bitcoin into alts. These major players are not here to play the rotation game … they’re locking up their BTC for years. And that reduces the chances of a wide altcoin rally triggered by Bitcoin profit-taking, which was a major reason past altseasons happened.

📊 Sources:

👉 New to BTC? Start here: Bitcoin Essentials Course

2. Retail interest is low, and rotation is just not happening.

One of the biggest drivers of altseasons has always been retail traders …. the average investors who jump into crypto when prices start going up. In previous cycles, once Bitcoin went up, these retail investors would start selling BTC to buy alts, hoping for faster, bigger returns. That kind of mass rotation created the huge altcoin rallies we saw in 2017 and 2021.

But right now, that retail energy is missing. Many regular users either lost money in previous crashes or simply moved on. Google search trends and exchange data clearly show lower retail engagement. Without this mass retail push, the fuel for altcoin rallies just isn’t there.

📊 Source:

3. There are way too many tokens now, and liquidity is spread thin.

In 2021, there were around 10,000 coins in total. Now in 2025, that number has exploded … there are over 40 million tokens live on various blockchains. That sounds like innovation, but it comes with a big issue: liquidity dilution.

The total market cap of crypto hasn’t grown 20x. It’s more or less in the same ballpark, but now it’s being split among a huge number of coins. That means most of the new or existing altcoins don’t have enough volume or investor focus to pump properly. Back then, a small push in one altcoin could lead to big gains. Now? Everything is scattered. Too many coins, not enough capital per coin.

📊 Source:

4. Regulatory pressure is hitting altcoins hard.

One of the major reasons investors are staying away from altcoins is because of regulatory risks. While Bitcoin is generally seen as “safe” from a legal point of view .. even accepted as a commodity in many countries … altcoins don’t have that luxury. The SEC and other regulators are going after altcoins hard, claiming many of them are unregistered securities.

Because of this uncertainty, serious investors, especially institutions, don’t want to take risks with altcoins. They’re either ignoring them completely or pulling money out. That lack of confidence directly hurts the chances of a broad altseason where everything goes up.

📊 Sources:

5. The market is running on short-term hype, not real altseason momentum.

Even though some tokens still pump …. like memecoins, AI coins, or Real World Asset tokens … these are just short bursts. They’re isolated events based on narratives or trends. There’s no unified movement where a large set of altcoins pump together like in traditional altseasons.

Right now, it’s just about chasing the next trend for a week or two. Memecoins like PEPE or WIF go up fast, but then fall equally fast. Same with AI and RWA coins. This behavior shows us that we’re not in a real altseason. It’s more like mini pumps that don’t last or impact the full market.

📊 Source:

Final Thoughts

So, is altseason completely dead? Not necessarily. But it’s definitely not the same as what we’ve seen in past years. The cycle has changed. Retail is quiet, regulation is tight, and Bitcoin is now being treated like an asset to hold, not rotate.

If you’re still hoping to get rich off random altcoins like it’s 2017 or 2021, it might be time to adjust your strategy. Before diving into alts, make sure you actually understand Bitcoin, the foundation of this entire space.

👉 Check out our Bitcoin Essentials Course — it’s designed to give you real, practical understanding of how BTC works and why it’s still at the center of this market.