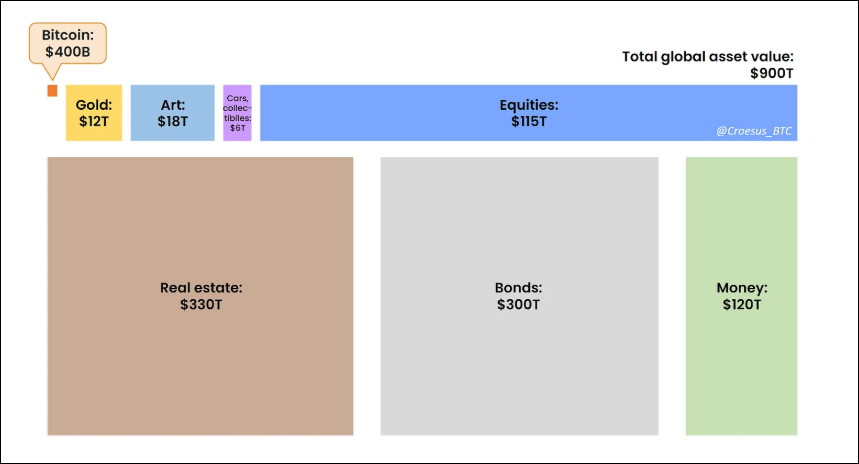

The Bitcoin market cap today sits at just $400 billion. At first glance, this may seem like a big number. But when you compare the Bitcoin market cap to the $900 trillion in global assets, Bitcoin is still a drop in the ocean. And that’s exactly why many investors see Bitcoin as a once-in-a-generation growth opportunity.

Bitcoin vs Global Assets

Let’s break down the global asset chart:

- Real Estate: $330 trillion

- Bonds: $300 trillion

- Equities: $115 trillion

- Money (cash and deposits): $120 trillion

- Gold: $12 trillion

- Art: $18 trillion

- Cars and Collectibles: $6 trillion

- Bitcoin: $400 billion

When compared with these categories, the Bitcoin market cap is not even 1% of global wealth pool.

Why This Gap Matters?

Bitcoin has been called “digital gold,” and the comparison makes sense. Gold sits at a $12 trillion market cap, thirty times larger than Bitcoin. If Bitcoin continues to be adopted as a store of value, even reaching half of gold’s size would push its market cap into the trillions.

And here’s where it gets interesting:

- Institutional adoption is only beginning (ETFs and sovereign wealth funds are warming up).

- Corporate balance sheets are experimenting with Bitcoin as a hedge.

- Retail adoption is still small compared to equities and bonds.

This means most of the capital hasn’t even arrived yet.

The Potential of Bitcoin

Bitcoin doesn’t need to replace real estate or bonds. It simply needs to carve out its niche as a global settlement layer and hedge against inflation. Even a 2% to 5% allocation of global assets into Bitcoin would move its market cap into the tens of trillions.

For long-term investors, this is a signal: we’re still early.

Conclusion

Bitcoin’s current $400 billion market cap might look small in the shadow of $900 trillion in global wealth. But that’s the exact reason many see it as a generational opportunity. If gold, equities, or real estate show us anything, it’s that capital flows toward assets that combine security, scarcity, and global demand. Bitcoin is quietly positioning itself in that direction.

So the question is: When the rest of the financial world catches on, where will Bitcoin stand?