Ever wondered what could actually drive Bitcoin’s next big move?

I did. So I asked ChatGPT a simple question… where could Bitcoin’s price realistically go next?

And what came out wasn’t hype. It wasn’t “to the moon” talk either. It was a logical, data-backed breakdown of how powerful trends already in motion could reshape this entire market.

(Image alt text : “Bitcoin price prediction 2030 chart”)

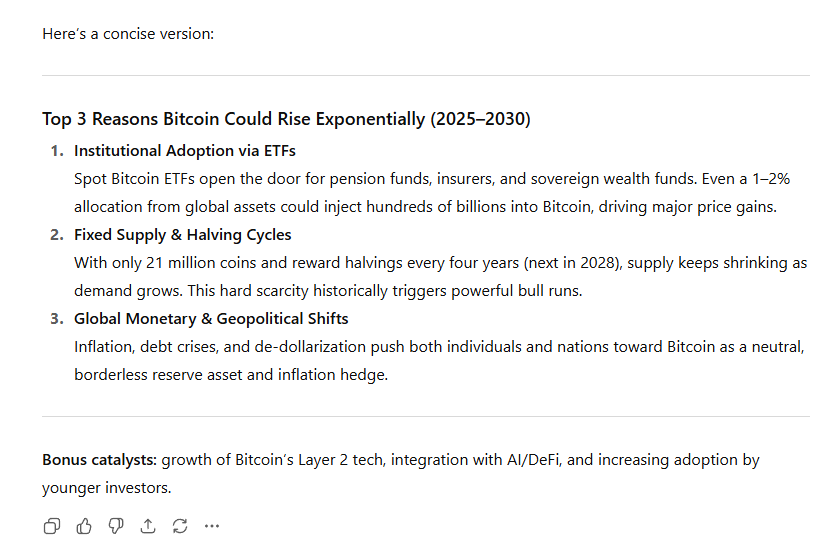

Institutional Adoption Through ETFs

For the first time, pension funds, insurance companies, and even sovereign wealth funds can gain exposure to Bitcoin through regulated ETFs.

Think about it. Even a one or two percent reallocation of global assets into Bitcoin could mean hundreds of billions of dollars in inflows. That kind of capital has never existed in Bitcoin before.

ETFs bridge the gap between traditional finance and decentralized money, and that bridge is now open.

Learn about Bitcoin ETFs on Cointelegraph

Fixed Supply and Halving Cycles

Bitcoin has a fixed supply of 21 million coins. Every four years, the reward miners receive for validating transactions is cut in half. This event is called the halving.

It’s happened before… in 2012, 2016, and 2020. And every time, Bitcoin’s price eventually surged.

The next halving is expected in 2024. History doesn’t repeat perfectly, but it often rhymes. The same pattern is quietly forming again.

Learn more about it on Bitcoin Essentials Course by Azad Money

Global Monetary and Geopolitical Shifts

Inflation. Rising debt. Geopolitical uncertainty.

The world is realizing the need for a neutral, borderless asset that can’t be printed, manipulated, or inflated away. Bitcoin fits that role naturally.

It’s not a short-term trade anymore … it’s a structural shift in how the world defines trust and value.

VARA – Dubai’s Virtual Assets Regulatory Authority

Where could Bitcoin Price Prediction By 2030 be?

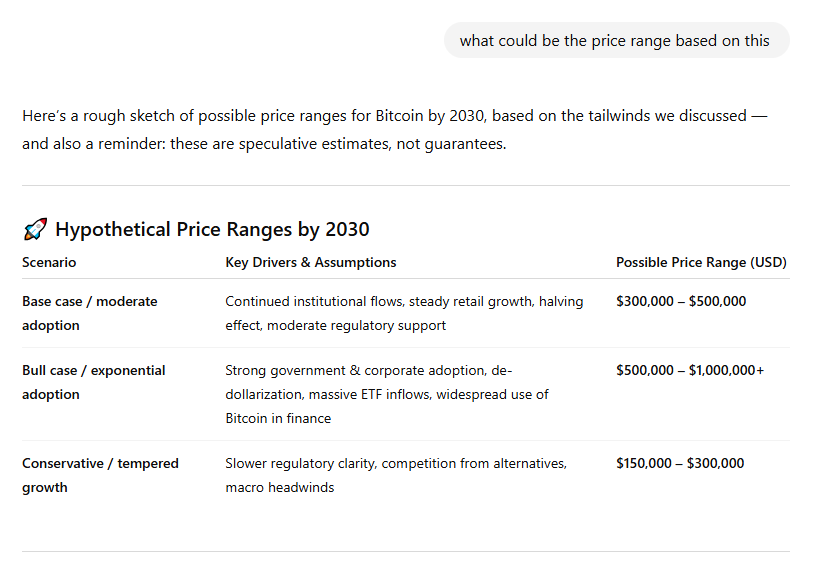

After studying all these trends, ChatGPT laid out three possible paths for Bitcoin by 2030:

- Base Case: $300,000 to $500,000

- Bull Case: $500,000 to $1,000,000 or more

- Conservative Case: $150,000 to $300,000

At first, it sounds unreal. But the logic checks out. Institutional inflows are rising. Supply is tightening. Global trust is shifting.

This isn’t a wild guess — it’s a repeating pattern built over a decade of data.

The Bigger Question

Maybe the question isn’t “can Bitcoin hit a million?”

Maybe it’s “what changes in the world if it actually does?”

Because every time the world doubted Bitcoin, it simply kept doing what it was built to do — run, block by block, with no off switch.

This is not financial advice. It’s perspective.

Real value builds quietly… long before everyone starts talking about it.