Discover how Bitcoin Smash Buy opportunities emerge during market panic and how disciplined investing beats emotional trading every time.

Understanding Bitcoin Smash Buy Opportunities

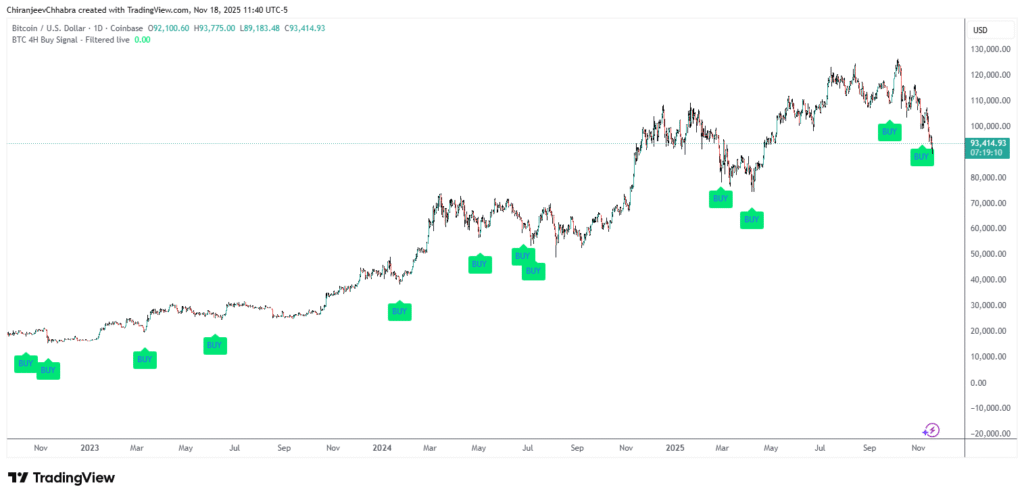

In the last two years, my in-house indicator has triggered 12 Bitcoin Smash Buy opportunities.

These weren’t lucky guesses. Each signal appeared when the market behaved exactly how humans do during fear and panic. And that’s where opportunity hides.

According to several studies on market behavior, over 70 percent of retail traders sell during volatility because they can’t handle emotional pressure. Data from Glassnode shows that during most drawdowns, long-term Bitcoin holders accumulate while new investors panic sell.

So, panic isn’t the exception. It’s the pattern.

Why Bitcoin Smash Buy Opportunities Exist

On average, Bitcoin has corrected more than 25 percent during over 20 different periods since 2015. Yet, in almost every single cycle, it has recovered and reached new highs.

These moments are what I call Bitcoin Smash Buy opportunities … points when fear blinds logic.

I am not a fan of so-called “secret indicators” or price prediction formulas. What I do believe in is process and discipline.

That’s exactly why I built this tool for myself … not to predict the future but to understand human behavior. Because once you go deep into Bitcoin’s rabbit hole, you realize something profound: Bitcoin is built on freedom, and freedom demands accumulation.

The Psychology Behind Smash Buy Signals

Every month, my question is the same … how do I accumulate more Bitcoin safely and smartly?

When markets crash, funding rates flip, sentiment breaks, and social media screams fear, my indicator turns green. Not because the market changes, but because people do.

Each of those 12 Bitcoin Smash Buy opportunities came during extreme panic selling. And every single one recovered in the following weeks or months.

These moments prove one thing …. fear creates opportunity.

You Don’t Need a Smash Buy Indicator to Succeed

Here’s the part most people don’t like hearing …. you don’t actually need a fancy indicator to build wealth.

More than 80 percent of Bitcoin’s long-term returns have come from simply staying invested and following a dollar-cost averaging (DCA) plan.

With DCA, you invest a fixed amount regularly …. weekly or monthly … regardless of price. Over time, this smooths out volatility and reduces emotional decision-making.

If you want to learn the basics of Bitcoin investing and how to build your own simple DCA process, check out the Bitcoin Essential Course by Azad Money. It’s designed for beginners who want to grow wealth without stress or guesswork.

Even data from multiple studies confirm that most DCA investors outperform active traders in the long run.

For most people, a consistent DCA plan is not just enough … it’s the best long-term Bitcoin Smash Buy opportunity they will ever have.

Building Wealth Through Patience

So whether you follow a structured signal like me or just invest a fixed amount every month, the mission remains the same.

Stack consistently.

Stay calm.

Stay long enough to benefit from Bitcoin’s design.

The next time Bitcoin crashes and the headlines scream panic, remember that these are the same conditions where smart investors find Bitcoin Smash Buy opportunities.

Cheers to the new money.

Get some Vitamin B and chill.

And if you want to understand how these Smash Buy zones form or how to build your own process, comment “Smash” below and we’ll connect for a one-on-one session.