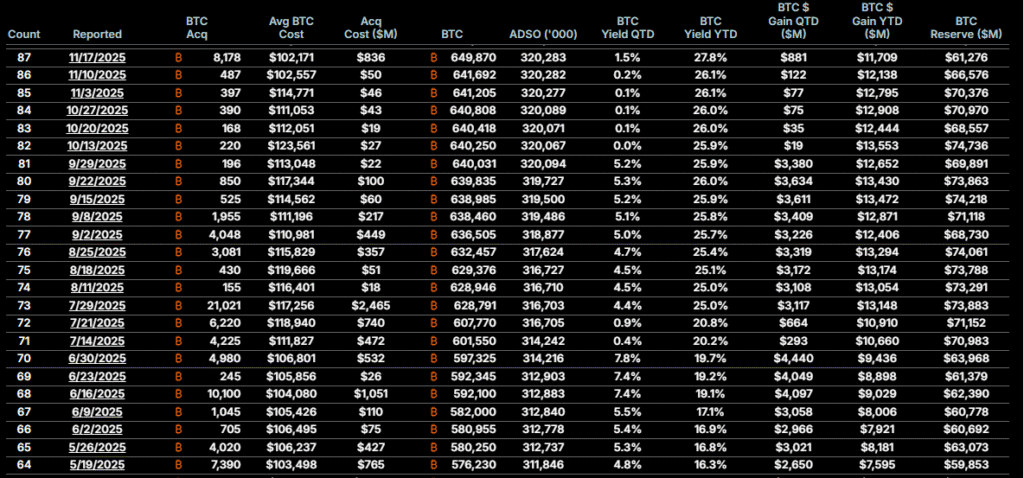

If you think holding Bitcoin long term is difficult, take a moment and look at the screenshot below. Every single line represents Bitcoin purchases made above 100K.

Not small amounts.

We are talking about tens of thousands of Bitcoin.

Now pause for a second and imagine this. Holding more than 72,000 Bitcoin, all bought above 100K, and still looking to buy more. That alone should change how most people think about holding.

This is not about hype. This is about conviction. And conviction only comes from understanding what you own.

Why Holding Bitcoin Long Term Requires Understanding, Not Courage?

I am not saying you should go all in. That is never the point. Blind risk is not strategy.

What I am saying is this. If you truly understand Bitcoin, price drops stop feeling scary. They start feeling like opportunities. Opportunities to stack whatever you can without disturbing your current financial life.

This is the mindset behind holding Bitcoin long term. You are not reacting to price. You are responding to fundamentals.

Some people argue about the Saylor playbook. Whether you agree with his strategy or not is a separate debate. His buying style does not change Bitcoin itself. It does not change how the network works. It does not change real world usage.

Large buyers may cause short term price swings. That is noise. Bitcoin has always been volatile in the short term and steady in the long term.

A Simple Framework For Holding Bitcoin Long Term

What I personally suggest is simple and practical. Even 1 percent of your income can go into saving in Bitcoin. You barely feel it.

This removes emotional pressure. It removes fear. And it makes holding Bitcoin long term sustainable.

When markets crash, that is when you slightly increase allocation. Not aggressively. Not emotionally. Just calmly.

This is not about timing tops or bottoms. It is about consistency and patience. Keeping your time horizon long enough for the system to work. At least five years.

More than 80 percent of Bitcoin’s long term gains historically came from simply staying invested, not from perfect entries.

If you want a clear foundation on how Bitcoin works and how to approach it responsibly, the Bitcoin Essential Course by Azad Money breaks everything down in simple language.

Why Fiat Weakness Strengthens Holding Bitcoin Long Term?

Fiat printing is not slowing down. Money supply continues to expand across the world. Governments cannot stop borrowing. Debt does not shrink. It grows.

When you zoom out far enough, the picture becomes clear. There is only one form of sound money that cannot be printed. Bitcoin.

This is why holding Bitcoin long term is not a trend. It is a response to a broken monetary system.

You can see this clearly when you study long time frame charts. Short term volatility fades. Long term direction becomes obvious. You can explore this on TradingView’s Bitcoin charts.

Time Is The Real Strategy

Holding Bitcoin long term is not about being fearless. It is about being informed.

Keep stacking.

Keep learning.

Keep your horizon long enough to let time do its job.

Bitcoin does not need hype to survive. It needs patience. And patience has historically rewarded those who practiced holding Bitcoin long term.

Let’s have a real discussion in the comments.