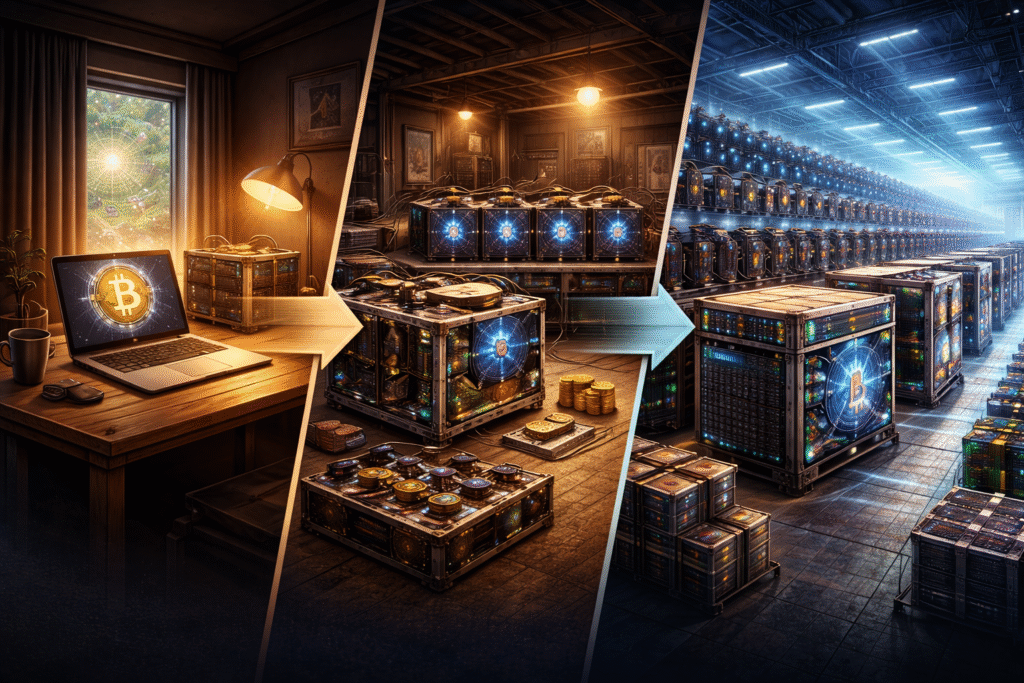

Bitcoin mining centralization over time emerged quietly as pools and ASIC manufacturers concentrated power through efficiency and scale.

Bitcoin Mining Centralization Over Time Did Not Happen Overnight

This did not arrive with an announcement. It happened quietly, layer by layer, as incentives shifted.

Most people think mining is just machines running and blocks being found. That was my assumption too, until I looked deeper into how mining actually evolved.

In the earliest years, from 2009 to 2010, mining was radically simple. Anyone with a laptop could participate. Block rewards were 50 BTC. There were no pools, no ASICs, and no intermediaries. Mining was permissionless in practice, not just in theory.

How Efficiency Drove Bitcoin Mining Centralization Over Time

As Bitcoin gained value, mining shifted from a hobby to a business. Variance became a problem. Individual miners could go long periods without finding a block, making income unpredictable.

That is when mining pools emerged. Pooling hash power reduced variance and stabilized payouts. On the surface, this made mining more efficient and accessible.

But under the hood, Bitcoin mining centralization over time began to take shape. Pools introduced a layer where block construction and policy decisions could concentrate, even if hash power itself remained distributed.

Efficiency solved one problem and quietly introduced another.

ASIC Manufacturing and Structural Dependence

Mining did not just centralize at the pool level. It centralized at the hardware level.

According to public industry data, ASIC manufacturing today is highly concentrated:

Bitmain controls roughly 70 to 80 percent of global ASIC production.

MicroBT controls around 10 to 15 percent.

Canaan holds about 5 to 10 percent.

Together, more than 90 percent of ASIC supply comes from just three manufacturers.

This is a critical component of Bitcoin mining centralization over time. Hardware supply determines who can mine efficiently. Access to machines, delivery timelines, firmware control, and chip design all influence participation.

Bitcoin did not break because of this. But it did become dependent.

You can track mining hardware and pool distribution trends using public data from Blockchain.com.

Why Bitcoin Still Works Despite Centralization Pressures?

It is important to be precise here. Mining centralization does not mean Bitcoin has failed. The network continues to produce blocks reliably. Consensus remains intact. Attacks have not materialized.

But decentralization is not binary. It is a spectrum.

Bitcoin mining centralization over time shows how convenience, scale, and efficiency can gradually replace diversity if left unexamined. Dependency does not announce itself. It accumulates.

This is why discussions around open hardware, transparent firmware, and non custodial pools matter. They are not reactions to failure. They are preventative measures.

Awareness Is the First Layer of Defense

The goal is not to reject efficiency. It is to remain aware of trade offs.

Understanding Bitcoin requires looking beyond price and performance and into incentive structures. The Bitcoin Essential Course by Azad Money provides a clear foundation on Bitcoin’s design, mining incentives, and long term security model.

Knowledge does not eliminate risk. It helps you see it early.

The Question That Remains

Bitcoin mining works. That is not in dispute.

The deeper question raised by Bitcoin mining centralization over time is whether dependence quietly replaces decentralization when efficiency goes unquestioned.

Does mining efficiency justify hardware concentration?

Or should resilience be prioritized even if it slows things down?

Curious to hear your view.

Let’s continue the discussion in the comments.