“You know what I used to think?

That Bitcoin was just… slipping out of people’s hands. Like sand.”

For years, I saw the headlines: people panic selling, “taking profits,” or fleeing at the first sign of volatility. It looked like Bitcoin was losing steam.

But then I started digging deeper into where that Bitcoin actually goes. And what I found changed my entire perspective.

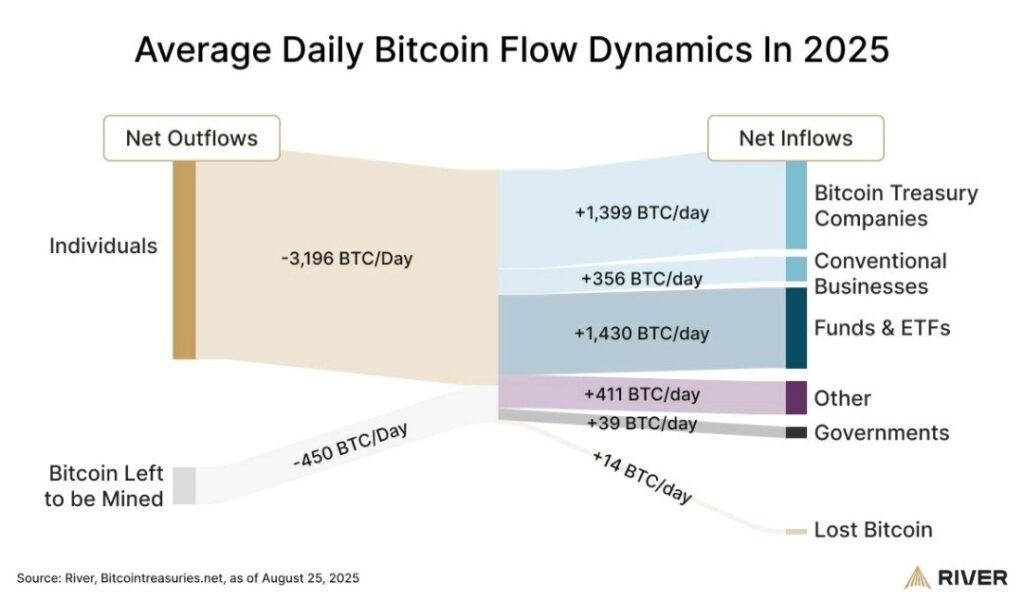

The Daily Flow of Bitcoin

On average, around 3,200 BTC leaves retail wallets every single day.

At first glance, that sounds bearish. Weak hands are selling. Retail traders are running for the exit.

But here’s the twist almost nobody talks about: that Bitcoin doesn’t disappear. It flows.

- 1,399 BTC daily → Treasury companies

- 1,430 BTC daily → Funds & ETFs

- 356 BTC daily → Businesses

- 39 BTC daily → Governments (yes, they’re stacking too)

This isn’t Bitcoin evaporating it’s Bitcoin changing owners.

The Supply Side Is Even Tighter

Now let’s look at the supply side:

- Only ~450 BTC/day is mined at current difficulty

- About 14 BTC/day is lost forever

Compare that with thousands flowing into institutions, corporations, and governments … and you start to see the imbalance.

The Shift in Power

Retail investors are selling.

Institutions are buying.

Governments are buying.

Every day, Bitcoin is moving into stronger, stickier hands.

That’s not weakness. That’s consolidation.

Why It Matters

When I realized this, it hit me: Bitcoin isn’t dying it’s maturing. It’s quietly transforming into the ultimate store of value.

Because eventually, wealth won’t be measured in fiat anymore.

It’ll be calculated in sats.

The question is: Will you be the one selling… or the one accumulating?

📊 Data Source: River