As geopolitical tensions flare once again—this time involving Israel, Iran, and the United States—investors are turning to a familiar question: How does Bitcoin respond in times of global crisis?

While often criticized for its volatility, Bitcoin’s historical performance during periods of upheaval tells a more nuanced story. Beneath the price swings lies a consistent pattern: short-term shakiness, followed by long-term strength.

Short-Term Reactions: Volatile but Not Predictable

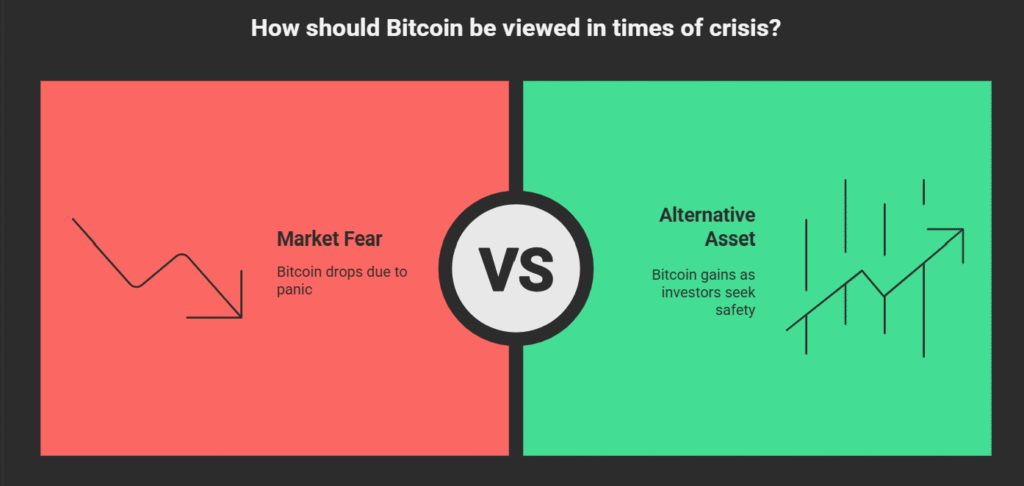

In the immediate aftermath of major global events, Bitcoin tends to react quickly, sometimes following broader market fear, sometimes charting its course.

Consider recent crises:

- During the early days of the COVID-19 pandemic, Bitcoin dropped roughly 25% as panic gripped global markets.

- Yet during the U.S. banking crisis in 2023, it gained 25% in just days, as investors looked for alternatives to traditional finance.

The takeaway? Bitcoin is reactive in the short run, but not always in ways people expect.

60-Day Horizon: Asymmetric Outperformance

When we zoom out beyond the first few days, a clearer trend emerges. Bitcoin has often outperformed traditional assets like the S&P 500 and even gold in the 60 days following major crises.

Notable examples:

- +131% following the U.S. election turmoil in 2020

- +32% after the 2023 banking crisis

- +21% in the wake of the COVID shock

These gains aren’t just rebounds—they suggest Bitcoin’s role as an asymmetric macro hedge is increasingly being recognized.

Bitcoin: Not Just Risk—But Optionality

Volatility is part of the deal with Bitcoin. But what’s often missed is its resilience. In dislocated markets, Bitcoin has shown a consistent ability to recover faster and stronger than many other assets.

As the current Middle East crisis unfolds, Bitcoin’s response will likely serve as a signal for institutional investors and high-conviction allocators seeking long-term optionality in a world full of unknowns.