As of today, Bitcoin represents roughly 64% of the entire crypto market capitalization, and that share climbs even higher if you exclude stablecoins.

This isn’t a short-term anomaly. It’s a structural shift in how capital is being allocated across digital assets.

Why It Matters:

A Flight to Quality

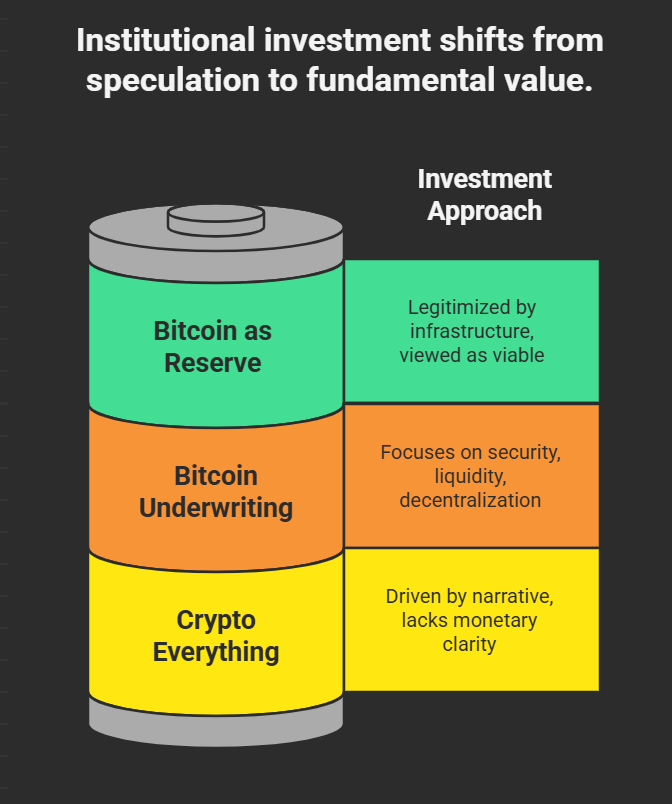

With global regulators tightening oversight and market participants growing more risk-averse, capital is increasingly consolidating into Bitcoin, the most secure, liquid, and decentralized digital asset. Institutions are seeking resilience, and Bitcoin delivers.

The End of “Crypto Everything”

We’re witnessing the end of the speculative “blockchain for everything” era. In its place is a renewed focus on monetary clarity.

Today, institutions aren’t buying into “crypto”—they’re underwriting Bitcoin.

Confidence Through Infrastructure

The launch of spot Bitcoin ETFs, institutional-grade custody solutions, and clearer regulatory frameworks has legitimized Bitcoin in the eyes of conservative capital allocators. What was once considered fringe is now viewed as a viable reserve asset.

The signal is unmistakable:

Institutional capital is no longer moved by hype or narrative. It’s being deployed with precision toward fundamentals. And in this emerging order, Bitcoin stands alone.