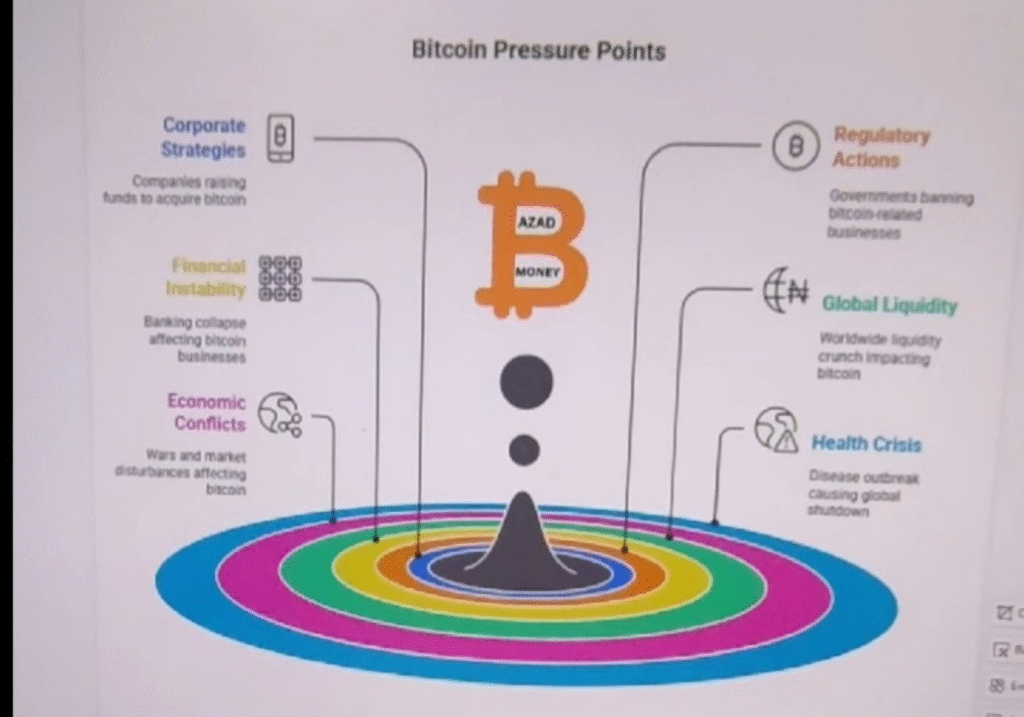

The Bitcoin pressure points reveal the vulnerabilities that can affect its adoption and long-term stability. While Bitcoin is often seen as digital gold, its growth depends on how it weathers challenges like regulation, global liquidity, health crises, and financial instability.

Understanding these Bitcoin pressure points helps investors and enthusiasts make informed decisions in an unpredictable financial landscape.

Corporate Strategies: Companies raising funds to acquire Bitcoin

More companies are shifting their strategies to acquire Bitcoin as part of their balance sheet. From Tesla to MicroStrategy, raising funds to purchase Bitcoin has become a signal of confidence. However, when corporations take bold steps, they can also create market volatility if they reverse their strategies.

Financial Instability: Banking collapse affecting Bitcoin businesses

Bitcoin may be decentralized, but its ecosystem still depends on exchanges, payment processors, and banks. Banking collapses or instability can directly affect Bitcoin businesses, creating liquidity crunches and limiting accessibility. This makes financial instability a critical Bitcoin pressure point.

Economic Conflicts: Wars and market disturbances

Geopolitical tensions and wars often disrupt global markets …. and Bitcoin is no exception. While some view Bitcoin as a safe-haven asset, market disturbances and sanctions can reduce liquidity, increase volatility, and change adoption rates. Economic conflicts remain one of the most unpredictable pressure points for Bitcoin.

Regulatory Actions: Governments banning Bitcoin-related businesses

Governments worldwide are actively shaping the future of Bitcoin through regulation. From outright bans to strict tax rules, regulatory actions are among the most powerful Bitcoin pressure points. While regulation can legitimize Bitcoin, overregulation risks slowing adoption and innovation.

Global Liquidity: Worldwide liquidity crunch

Liquidity is the lifeblood of financial markets. A worldwide liquidity crunch can make it harder for investors to buy and sell Bitcoin smoothly. When global markets tighten, Bitcoin is often affected, making liquidity a vital factor in its price movement.

Health Crisis: Disease outbreak and global shutdowns

The COVID-19 pandemic highlighted how health crises can affect global economies. Lockdowns, restrictions, and shutdowns also impacted Bitcoin adoption, mining, and trading activity. Any future global health crisis could again act as a pressure point for Bitcoin.

What these Bitcoin pressure points mean for the future

Bitcoin’s journey is shaped by external forces as much as by its own network fundamentals. Corporate adoption, regulation, global liquidity, and even unforeseen crises all play roles in determining Bitcoin’s resilience.

For investors, understanding these Bitcoin pressure points means being prepared for volatility, regulation, and global events that influence digital finance.

👉 Learn Bitcoin the right way with our Bitcoin Essentials Course

👉 For further insights on global Bitcoin regulation, see this Cointelegraph report