When it comes to predicting market tops, one of the most effective tools for Bitcoin traders is tracking BTC flows to exchanges. This metric can reveal when a Bitcoin price correction may be approaching – whether short-term, mid-cycle, or part of a long-term shift.

Green Bars and Bitcoin Price Correction Patterns

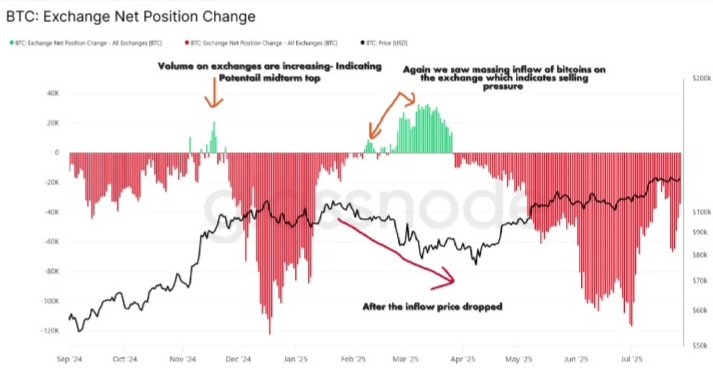

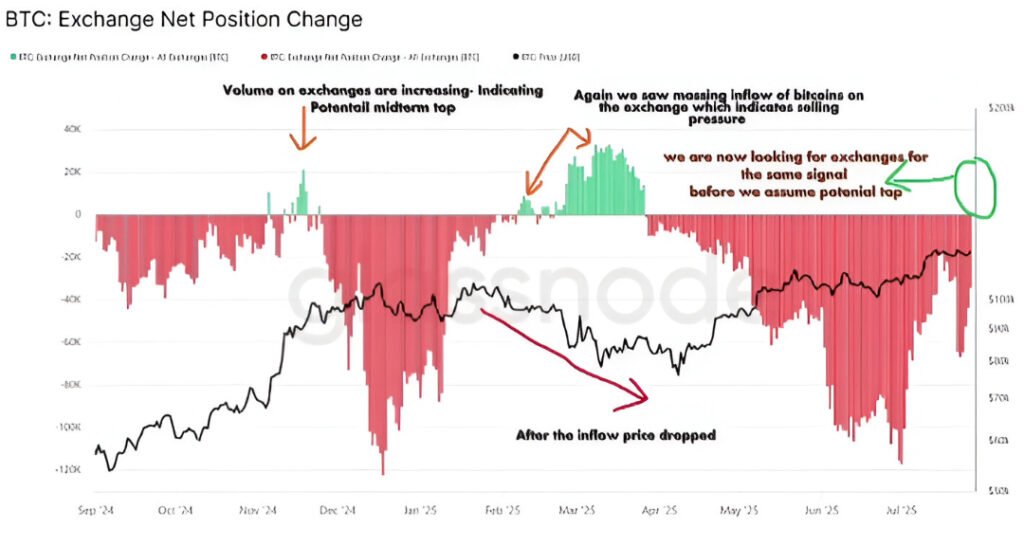

The first chart shows green bars that indicate a potential sell signal. When these green bars appear and begin to rise, it usually means more BTC is moving to exchanges, suggesting traders are preparing to sell. Historically, this has been an early warning of a mid-term top.

Historical Bitcoin Price Correction: 90K to 79K Drop

In the second chart, we can see this pattern in action. When green bars surged, Bitcoin peaked between $90,000 and $100,000 before falling to around $79,000. This confirmed that the increased flow of BTC to exchanges aligned with a market correction.

Spotting a BTC Price Correction in the 120K to 150K Range

If green bars appear again when BTC trades between $120,000 and $150,000, it could signal a new all-time high followed by a mid-term correction. Recognizing this pattern early helps traders position for short-term moves and protect profits in long-term holdings.

Bitcoin Price Correction Strategies for All Traders

- Short-term: Take advantage of quick moves and volatility spikes

- Mid-term: Prepare for pullbacks after major rallies

- Long-term: Use corrections to accumulate at better prices

Additional Resources

For more detailed BTC market analysis, check out our Bitcoin Trading Strategies Guide and On-Chain Analytics Basics.

For more on Bitcoin on-chain analytics, visit Glassnode or CoinMetrics

Image Suggestions:

- Chart showing green bars (alt: “Bitcoin price correction signal with exchange inflows”)

- BTC price drop from 100K to 79K (alt: “Historical Bitcoin price correction example”)

Link to an authoritative source like Glassnode for on-chain data reference.

Check out our Bitcoin Essentials for more insights.