Weekly Bitcoin Outlook

At ~$96,000, Bitcoin remains one of the most mispriced assets—not due to lack of performance or attention, but because it’s still widely misunderstood. On a risk-adjusted basis, it’s never been more compelling.

The U.S. government has established a Strategic Bitcoin Reserve, signaling growing adoption. Several states are advancing similar initiatives. Key figures in national politics are backing Bitcoin as a cornerstone of sound money policy.

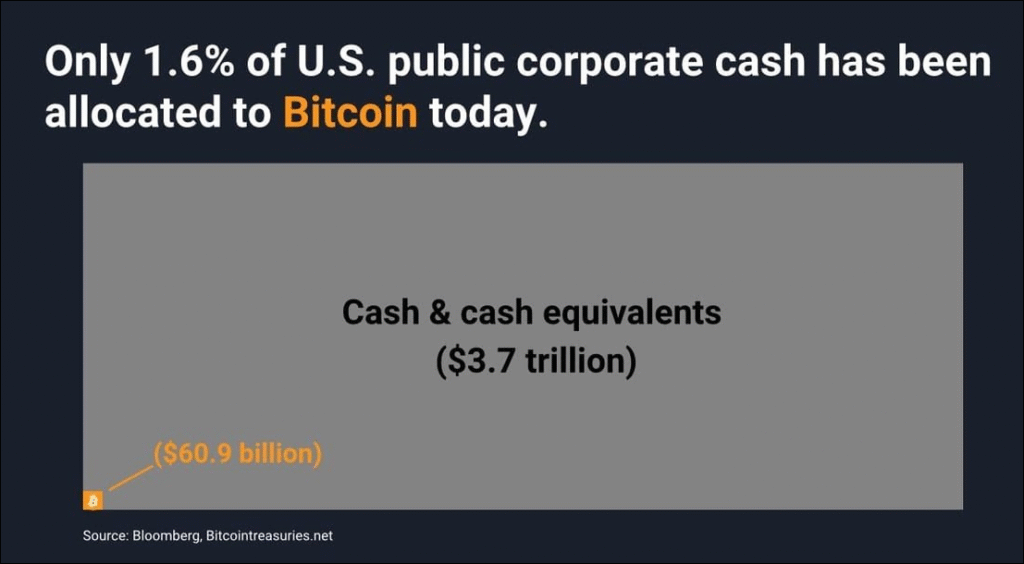

Institutional capital is just beginning to enter. Only a few S&P 500 companies hold Bitcoin, and most wealth platforms still restrict access to spot ETFs. Over $31 trillion remains locked out of the market.

Meanwhile, major firms like BlackRock, Cantor Fitzgerald, Tether, and MicroStrategy are aggressively accumulating. Yet most millionaires still hold zero Bitcoin—pointing to significant untapped demand.

Market conditions are turning favorable. Volatility is rising, liquidity is expanding, and the Fed may soon resume balance sheet growth. These macro signals have historically preceded Bitcoin bull runs.

Despite offering superior monetary traits—scarcity, portability, auditability—Bitcoin is still just a ~$2T asset, far smaller than gold. As confidence in traditional portfolios fades, Bitcoin’s role as a hedge is becoming clearer.

Adoption is accelerating. Every day, new individuals—from advisors to retirees—rethink old assumptions and choose to own at least some Bitcoin. The Overton window is shifting.

We may be entering the “suddenly” phase.

Just two years ago, this setup was unthinkable: post-FTX collapse, ETF approvals seemed impossible, and U.S. institutions were hostile. Now, momentum is building fast.

This is one of the most constructive Bitcoin environments ever—quiet, steady, and massively under-owned.