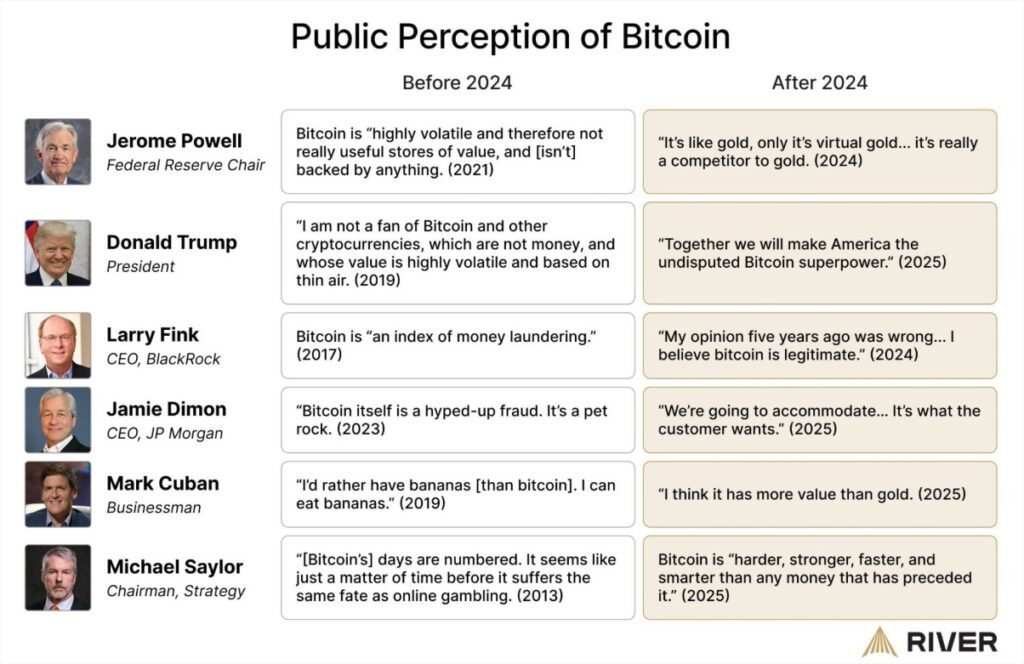

The public perception of Bitcoin has always been a rollercoaster. For years, world leaders, bankers, and billionaires laughed at it, mocked it, and dismissed it as a passing fad. But fast forward to 2024 and beyond, and the very same critics are now calling Bitcoin “virtual gold” and promising to make their countries Bitcoin superpowers.

This shift in the public perception of Bitcoin reveals a simple truth: the louder the skepticism, the bigger the eventual adoption. Let’s walk through some of the biggest 180-degree turns.

Jerome Powell – From “not backed by anything” to “virtual gold”

Back in 2021, Federal Reserve Chair Jerome Powell dismissed Bitcoin as “highly volatile” and “not backed by anything.” He saw no use for it as a store of value.

But by 2024, his tone changed dramatically. Powell called Bitcoin “like gold, only it’s virtual gold” and admitted it was “a competitor to gold.” When even the head of the world’s most powerful central bank compares Bitcoin to gold, you know the public perception of Bitcoin has shifted.

Donald Trump – From “thin air” to “Bitcoin superpower”

In 2019, Donald Trump made it clear: “I am not a fan of Bitcoin.” He dismissed it as money “based on thin air” and said it was too volatile.

Fast forward to 2025, and he’s now vowing to make America the “undisputed Bitcoin superpower.” That’s a major turnaround — from rejection to putting Bitcoin at the center of US economic leadership.

Larry Fink – From “money laundering index” to “legitimate”

Larry Fink, CEO of BlackRock, once called Bitcoin “an index of money laundering” back in 2017. That statement echoed the mainstream narrative that Bitcoin was only useful for criminals.

By 2024, Fink admitted he was wrong. “My opinion five years ago was wrong… I believe Bitcoin is legitimate.” And now, BlackRock operates one of the world’s largest Bitcoin ETFs. The public perception of Bitcoin flipped from criminal tool to financial instrument.

Jamie Dimon – From “fraud” to “we’ll accommodate”

Jamie Dimon, CEO of JP Morgan, was among Bitcoin’s harshest critics. In 2023, he called Bitcoin “a hyped-up fraud” and “a pet rock.”

By 2025, however, Dimon softened: “We’re going to accommodate… It’s what the customer wants.” Translation? If Bitcoin makes money, banks will play along. Even reluctant acceptance is proof that the perception of Bitcoin has changed at the highest levels of finance.

Mark Cuban – From “bananas are better” to “more value than gold”

In 2019, Mark Cuban joked, “I’d rather have bananas than Bitcoin. I can eat bananas.” It was one of the most famous dismissals of Bitcoin’s value.

By 2025, Cuban completely flipped, saying, “I think it has more value than gold.” From bananas to Bitcoin, the shift is a perfect example of how public perception evolves once the world realizes Bitcoin’s staying power.

Michael Saylor – From doubter to ultimate believer

In 2013, Michael Saylor said Bitcoin’s “days are numbered” and compared it to online gambling. Few expected him to become one of the loudest Bitcoin bulls in history.

By 2025, Saylor declared that Bitcoin is “harder, stronger, faster, and smarter than any money that has preceded it.” Today, his company holds more Bitcoin than most countries. His personal journey embodies the ultimate transformation in the public perception of Bitcoin.

What this shift tells us about the future

For years, critics called Bitcoin a scam, a fraud, or worse. People listened, stayed away, and missed opportunities. Yet behind the scenes, those same critics and their institutions built positions, launched ETFs, and positioned themselves for the next era of finance.

The biggest lesson? Public perception of Bitcoin always lags behind reality. While retail investors chase the “next Bitcoin,” world leaders and billionaires quietly accumulate the real one.

👉 Learn Bitcoin the right way with our Bitcoin Essentials Course

👉 For more on global Bitcoin adoption, check this Cointelegraph report

Chart Credit – River