Two terms are often used in digital assets: real estate tokenization and Bitcoin. Both claim to democratize finance, unlock new opportunities, and reshape how we think about ownership.

But beyond the hype, which one delivers?

Let’s take a closer look at both sides.

What Is Real Estate Tokenization?

Real estate tokenization is the process of converting physical property ownership into digital tokens on a blockchain. These tokens can then be sold in fractions, allowing investors to buy small portions of high-value assets like commercial buildings or luxury resorts.

It sounds revolutionary:

“Own property like you own stocks.”

“Buy and sell instantly, anytime, from anywhere.”

But the reality is far more complicated.

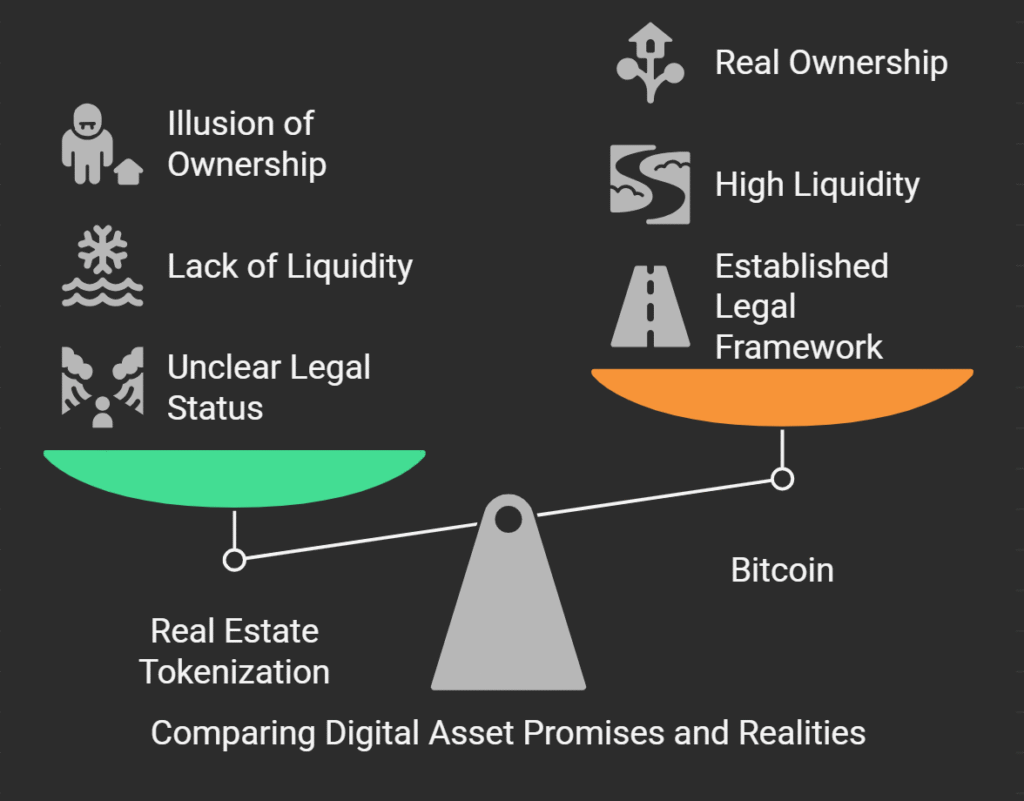

The Problems Behind the Pitch

1. Unclear Legal Status

Tokenized real estate operates in a legal grey area. Some jurisdictions consider tokens to be securities, while others offer no guidance at all. That leaves investors vulnerable to sudden policy changes or regulatory crackdowns.

In short: your digital “ownership” could be frozen, challenged, or invalidated at any moment.

2. Lack of Liquidity

Unlike stocks or crypto, tokenized property assets usually lack an active market. While a few have seen price spikes, most tokens can’t be sold easily, if at all.

No liquidity = no real exit. You might end up holding a digital deed no one wants to buy.

3. Technical & Platform Risks

Smart contracts power tokenized platforms. But a single line of buggy code can cause massive losses, as seen in multiple multimillion-dollar hacks in recent years.

And even worse? Many of these platforms are centralized. That means if the platform goes down or decides to restrict access, you could lose everything.

4. Ownership Is Often an Illusion

Owning a real estate token doesn’t always mean owning the actual land. You’re often just holding a claim that depends on a third party honoring it.

We’ve even seen cases of the same property being tokenized across different blockchains, with no unified title registry and no guarantee of enforcement.

What Makes Bitcoin Different?

Bitcoin offers a radically different proposition:

- Fully decentralized: No single entity controls it.

- Borderless and liquid: Buy or sell anytime, globally.

- Transparent rules: The protocol is open-source and governed by consensus.

- Hard-capped supply: Only 21 million will ever exist.

Bitcoin doesn’t pretend to be something it’s not. It doesn’t claim to offer rental income or property rights. It’s digital money with known rules and unmatched security.

Real Ownership vs. Promised Ownership

At its core, this comparison is about trust:

- Real estate tokenization asks you to trust platforms, regulators, and developers.

- Bitcoin asks you to trust math, code, and a decentralized network.

One is built on layers of intermediaries.

The other removes them entirely.

Institutions Are Interested—But That Doesn’t Mean It’s Safe

Yes, institutions are starting to explore tokenized assets. Some projections suggest 5–6% of portfolios may include them by 2026. But that doesn’t automatically make them sound investments. It just means large players believe they can exit before the risks materialize.

Final Thoughts: Which Should You Bet On?

Real estate tokenization might one day mature into a powerful, regulated tool for fractional investing. But today, it’s still in the speculative phase—plagued by legal confusion, illiquidity, and centralized risk.

Bitcoin, meanwhile, has already proven itself over more than a decade. It’s not just a concept. It’s a living, breathing financial network used by millions worldwide.

So if you’re choosing between owning a digital promise and owning a decentralized, borderless, liquid asset—the answer is clear.

Bitcoin offers clarity. Tokenization still offers questions.