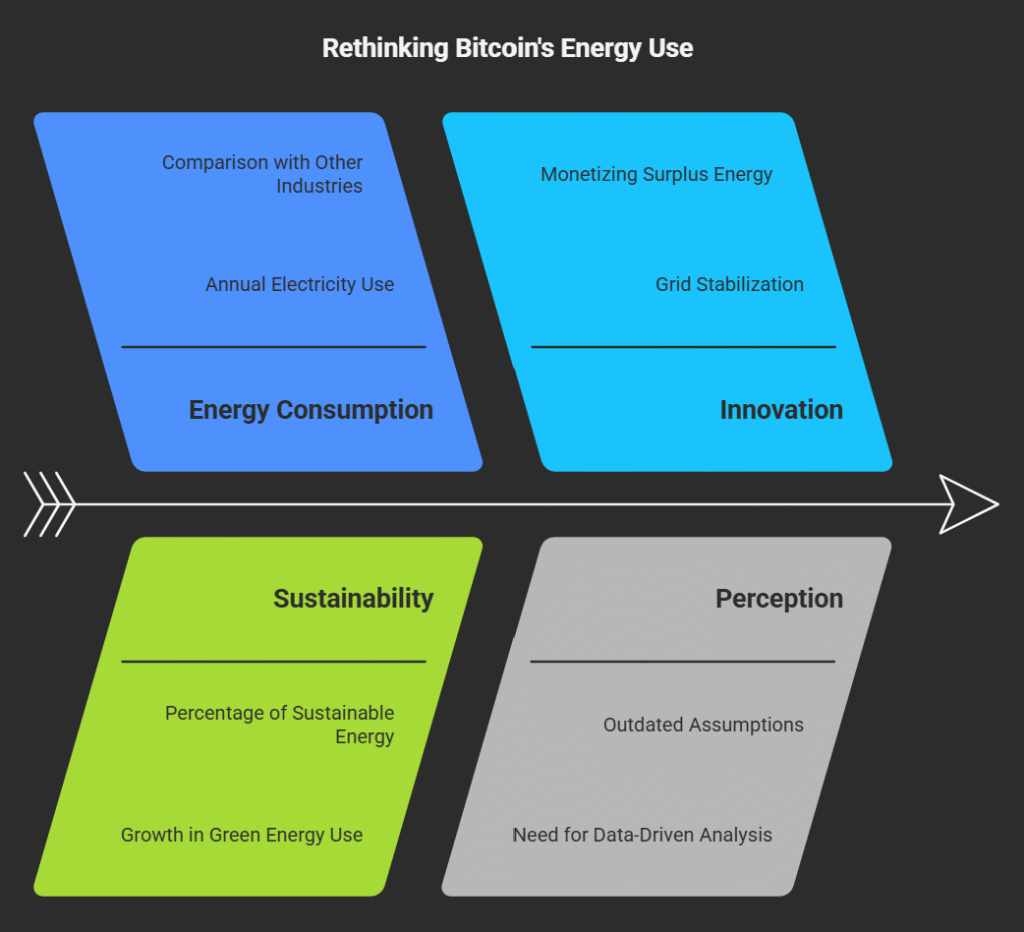

For years, Bitcoin has been cast as an energy guzzler—an easy target in climate and sustainability debates. But this oversimplified narrative is beginning to crack under scrutiny, revealing a more complex and promising picture.

Bitcoin currently consumes around 120–140 terawatt-hours (TWh) of electricity per year, which accounts for roughly 0.05% of global energy use, significantly less than the energy demands of the traditional banking system or gold mining.

What’s more, the Bitcoin network is already over 52% powered by sustainable energy sources, a figure that continues to grow. This makes it one of the more transparent and increasingly green energy users among global industries.

Beyond efficiency, Bitcoin is emerging as a powerful tool for energy innovation. Miners can help stabilize electrical grids, monetize surplus or stranded energy, and even drive rural electrification in remote areas, turning potential emissions liabilities into real-world ESG gains.

Far from being a burden, Bitcoin is evolving into a strategic energy asset—a flexible, location-agnostic demand layer that can enhance the resilience and sustainability of modern power infrastructure.

For institutional investors, energy providers, and infrastructure leaders, it’s time to move past outdated assumptions. Bitcoin’s misunderstood energy profile deserves a fresh, data-driven look.