While media headlines continue to obsess over Bitcoin’s price volatility, a quieter, more significant transformation is taking place—one that’s reshaping the financial landscape at its core.

Across boardrooms, investment committees, and sovereign wealth desks, the conversation around Bitcoin has matured. It’s no longer a matter of if Bitcoin deserves a place in a portfolio, but how much exposure is prudent, and how to manage custody and compliance effectively.

Why Institutions Are Leaning Into Bitcoin

🔶 A Hedge in an Uncertain Macro Climate

As global debt levels surge and concerns about fiat debasement rise, institutional allocators are seeking hard assets with predictable, non-inflationary properties. Bitcoin, with its capped 21 million supply, provides a compelling alternative.

“It’s a hedge against irresponsibility.”

— Stanley Druckenmiller

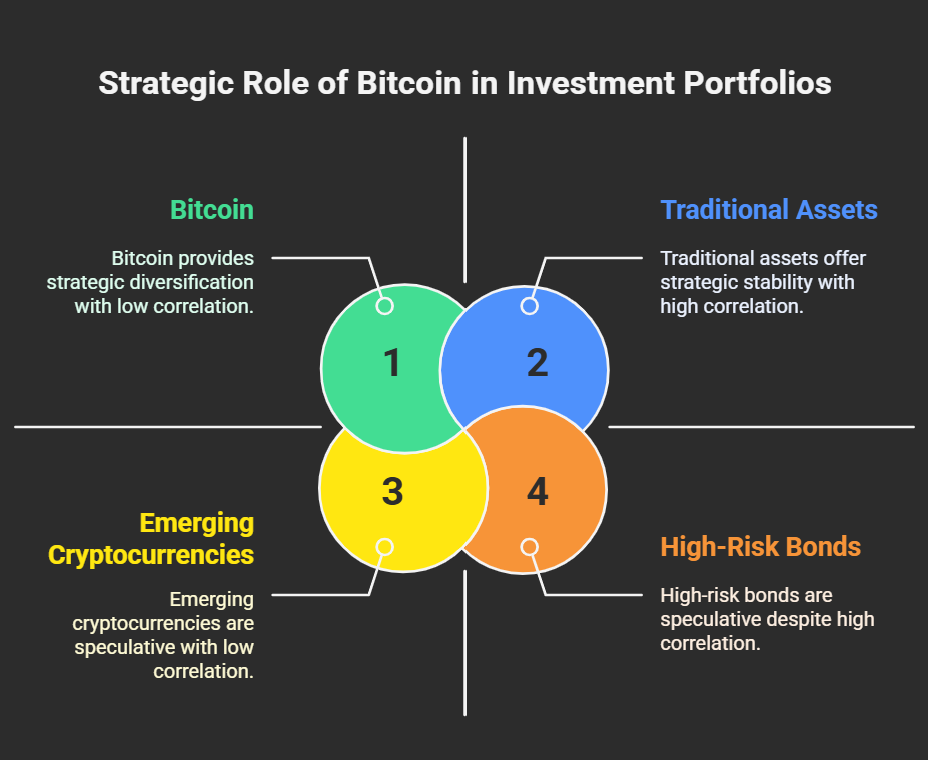

🔶 Diversification with Low Correlation

Bitcoin’s historically low correlation with traditional assets like equities and bonds allows for improved risk-adjusted returns in diversified portfolios. For many forward-looking CIOs and fund managers, Bitcoin is no longer speculative—it’s strategic.

“I came to the conclusion that Bitcoin was going to be the winner of this race.”

— Paul Tudor Jones

🔶 Infrastructure That Meets Institutional Standards

The 2024 approval of U.S. spot Bitcoin ETFs and the rise of institutional-grade custody solutions have eliminated many operational barriers. With firms like BlackRock, Fidelity, and Franklin Templeton entering the space, trust and access have scaled significantly.

“Bitcoin is here to stay. We see it as part of the future of the financial system.”

— Larry Fink, CEO, BlackRock