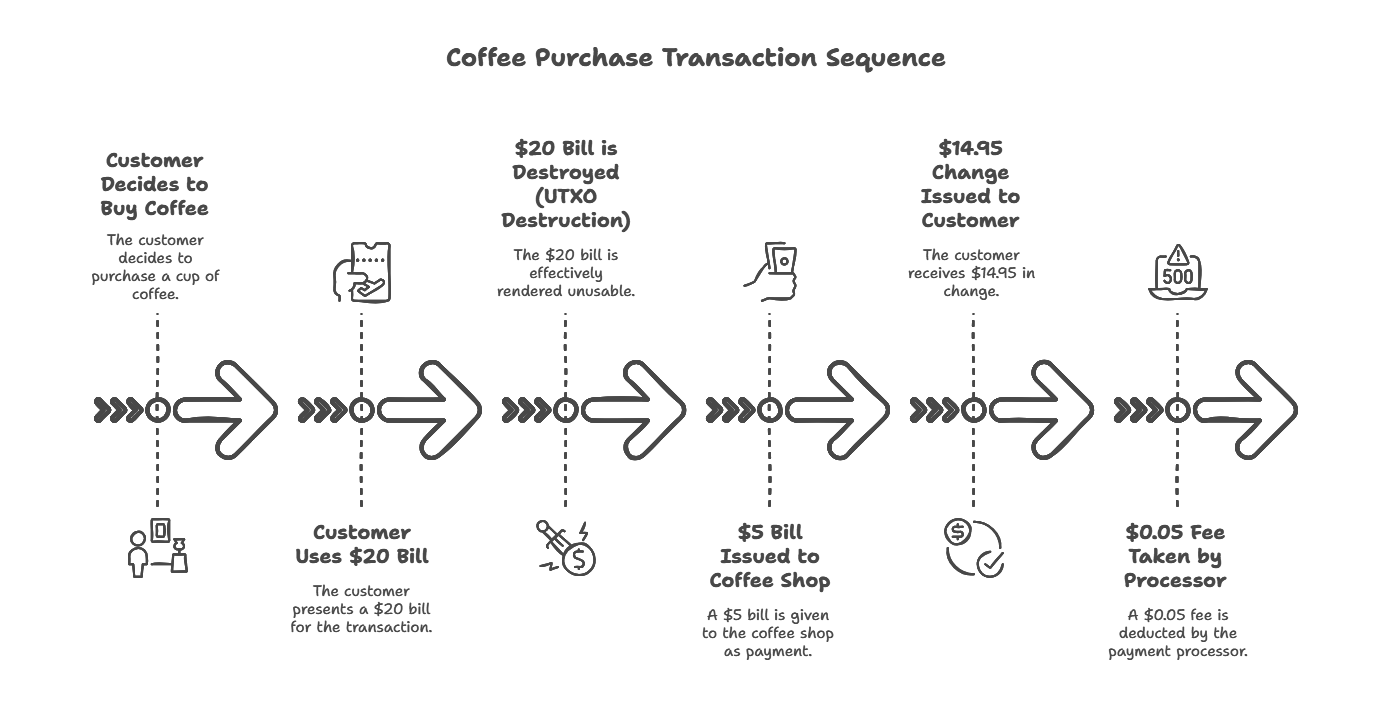

A Bitcoin transaction in real life is very similar to buying a cup of coffee with cash , Let me explain to you with an example

To buy a cup of coffee for $5 at a shop, the customer cannot simply tear off a piece of their $20 bill and pay only that portion. Instead, they must give the entire $20 bill to the cashier to ask for change (putting it into a “Cash Pot”).

Now imagine that $20 bill is destroyed and new set of bills are created to facilitate the transaction

This process destroys the original $20 bill (the UTXO is destroyed) and mints a new set of bills and coins with different denominations (UTXO creation). In this case, the transaction will result in:

- One $5 bill → paid to the shop owner

- A small fee of $0.05 → paid for the service provided (analogy: Bitcoin miners’ fee)

- One $14.95 in change → returned to the customer

Notes : all these $5, $0.05 and $14.95 are nothing but new UTXO’s created from this transaction

Breaking and Minting Cash

With the transaction, the network (the cashier or payment system) can divide and “mint” the $20 bill into any set of arbitrary denominations of “new bills and coins” (analogy: newly created UTXOs) and distribute them as needed.

Bitcoin miners, who are the equivalent of operators of the melting and forging equipment, take a small fee for their services (the transaction fee).

Total value remains the same: $5 + $14.95 + $0.05 = $20.

Understanding UTXOs, Market Activity, and Spending Patterns

Bitcoin’s Unspent Transaction Output (UTXO) model is a crucial component in tracking coin movements and analyzing market behavior. By examining the age, value, and spending patterns of UTXOs, we can gain valuable insights into investor sentiment, profit and loss trends, and the financial activities of major entities such as exchanges and miners. Let’s explore each point in detail.

1. The Significance of Old, Unspent UTXOs

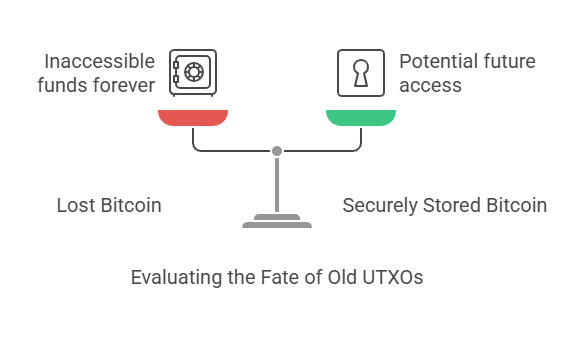

A UTXO represents a Bitcoin balance that remains unspent after a transaction. If a UTXO was created 10 years ago and has never been spent, there are two likely scenarios:

- The Bitcoin is lost – This could happen if the private key controlling the UTXO is lost, making the funds inaccessible forever.

- The Bitcoin is in secure storage – Investors might have stored their Bitcoin in cold wallets or vaults, intending to hold it for the long term.

Why This Matters:

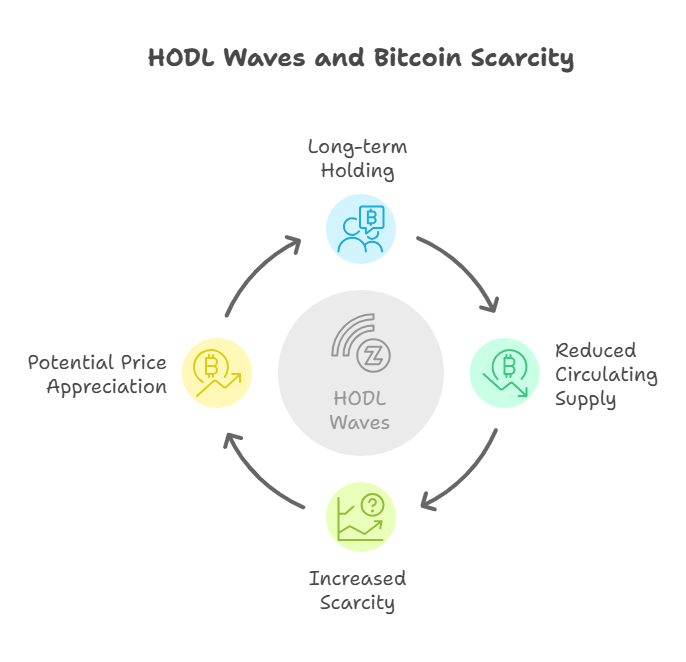

- Bitcoin with long unspent UTXOs (called “HODL waves”) indicate long-term holders who believe in Bitcoin’s future value.

- If a large portion of old UTXOs remain unspent, it reduces the circulating supply, which can lead to higher scarcity and potential price appreciation.

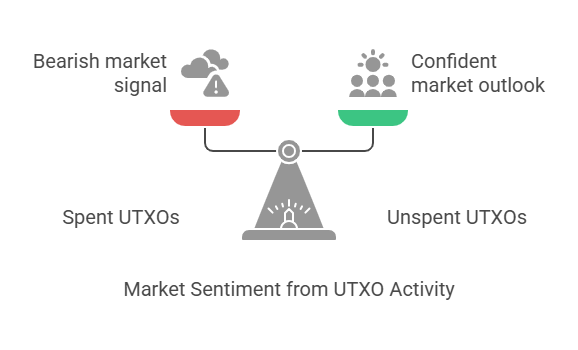

2. Large-Scale Spending of Old UTXOs as a Market Indicator

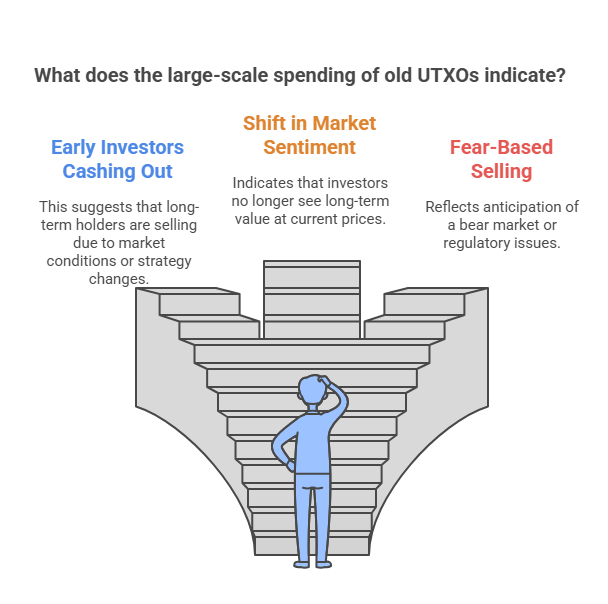

When a significant number of old UTXOs (created many years ago) are suddenly spent within a short period, it could indicate a major market event:

- Early investors cashing out – Long-term holders may decide to sell, possibly due to market conditions, economic factors, or changes in investment strategy.

- A shift in market sentiment – If many old UTXOs are spent at once, it may suggest that early adopters or institutional investors no longer see long-term value at current prices.

- Fear-based selling – Some long-term holders may liquidate their Bitcoin holdings if they anticipate a bear market or regulatory crackdowns.

Why This Matters:

- Analysts watch for spikes in the spending of long-dormant UTXOs as a potential bearish signal—suggesting large investors are exiting their positions.

- Conversely, if these old coins remain unspent, it signals strong long-term confidence in Bitcoin’s future.

3. Calculating Profit and Loss on UTXOs

Each UTXO was created at a specific Bitcoin market price. To determine the profitability of a transaction, we analyze:

- The market price when the UTXO was created (i.e., when the Bitcoin was acquired).

- The market price when the UTXO is spent (i.e., when the Bitcoin is used or sold).

Profit Calculation

- If a UTXO was created at $1,000 per BTC and later spent when BTC is $50,000, the owner made a $49,000 profit per BTC.

- If the market price has fallen below the original purchase price, the owner realized a loss on their investment.

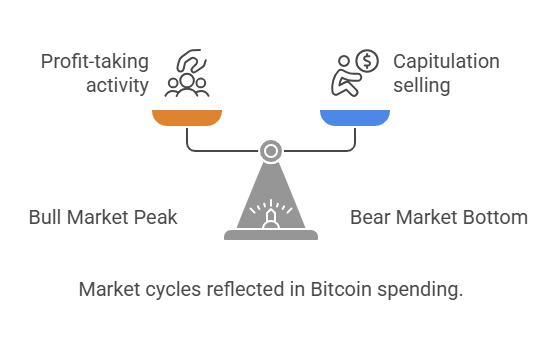

Why This Matters:

- Tracking Bitcoin holders’ profitability helps understand market cycles.

- Large amounts of Bitcoin being spent at a profit could signal a bull market peak where investors take profits.

- High levels of Bitcoin sold at a loss suggest capitulation, a common sign of a bear market bottom.

4. Identifying the Spending Behavior of Large Entities

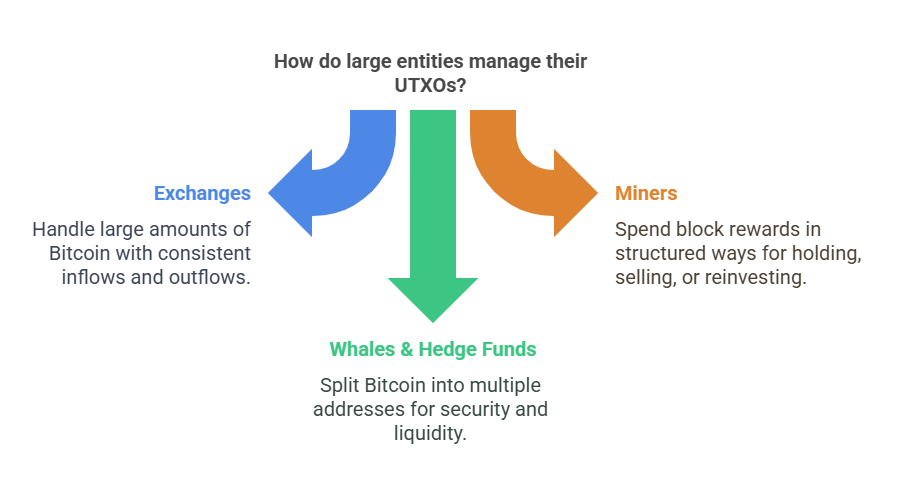

Some Bitcoin holders, like exchanges, miners, and institutional investors, follow predictable UTXO management patterns:

- Exchanges: Handle large amounts of Bitcoin moving in and out of wallets as users deposit and withdraw funds. Their UTXO spending patterns typically show consistent inflows and outflows.

- Miners: Receive block rewards in newly created UTXOs and tend to spend these coins in structured ways—either holding, selling for operational costs, or reinvesting.

- Whales & Hedge Funds: Large holders may split their Bitcoin into multiple addresses for security and liquidity management.

Why This Matters:

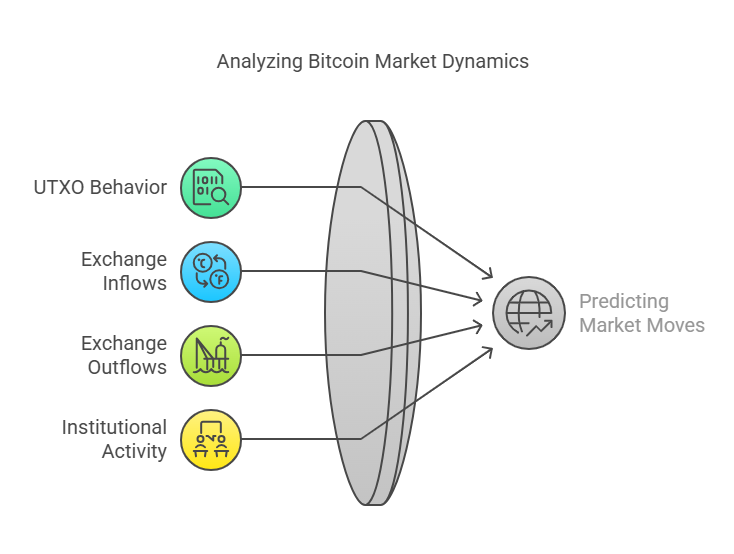

- By tracking UTXO behavior, we can estimate when exchanges and miners are selling Bitcoin, which can influence price movements.

- Watching exchange inflows (large deposits to exchanges) can signal increased selling pressure, while outflows from exchanges suggest accumulation and withdrawal to cold storage.

- Identifying these patterns helps analysts predict potential market moves, liquidity shifts, and institutional buying or selling activity.

Conclusion

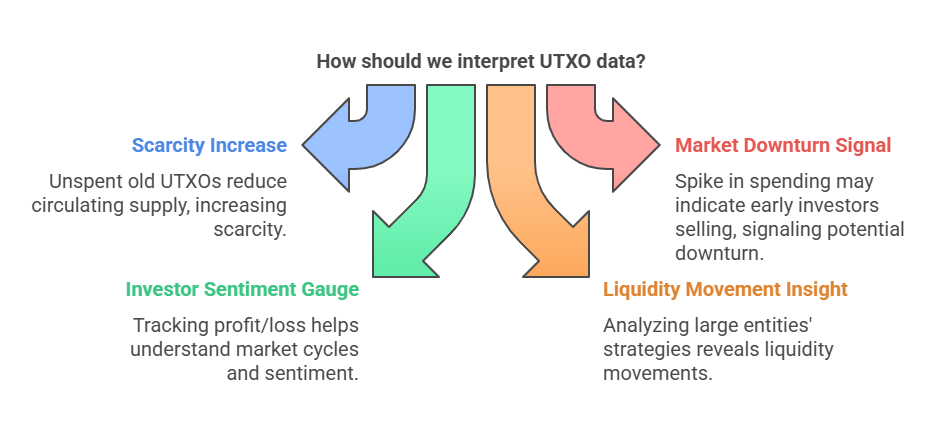

- Old UTXOs that remain unspent are likely lost or in secure storage, reducing the circulating Bitcoin supply and increasing scarcity.

- A sudden spike in spending of old UTXOs may indicate early investors selling, potentially signaling a market downturn.

- Tracking the profit/loss of spent UTXOs helps gauge investor sentiment and market cycles.

- Large financial entities like exchanges and miners follow predictable UTXO management strategies, which can be analyzed to understand liquidity movements and institutional behavior.

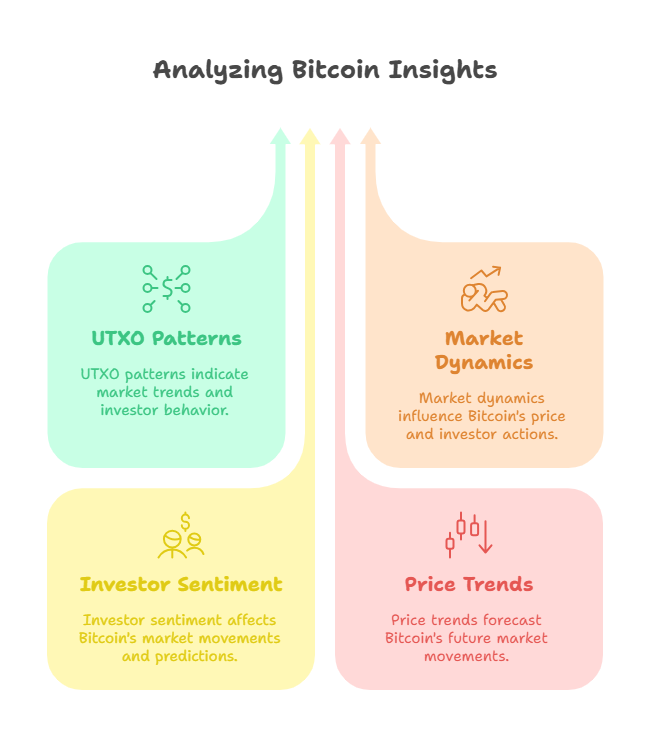

By analyzing UTXO patterns, we can gain deep insights into Bitcoin’s market dynamics, investor sentiment, and future price trends.

Learn more about it and book a consulting session with me !