Discover why Bitcoin will not stay low forever by understanding money printing, inflation, inequality, debt and the global shift toward alternative stores of value.

Why Bitcoin Will Not Stay Low Forever Begins With Understanding Money

Let me tell you something very simple. If you want to understand why Bitcoin will not stay low forever, just look at the world around you. Look at how money works today.

Do you really think governments will suddenly stop printing money?

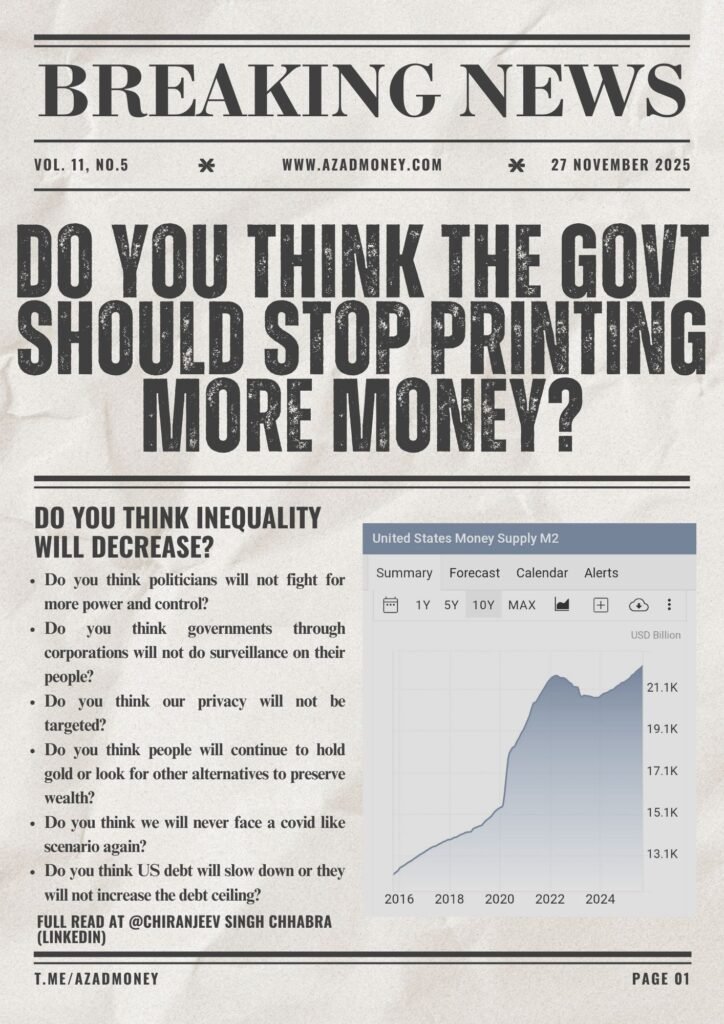

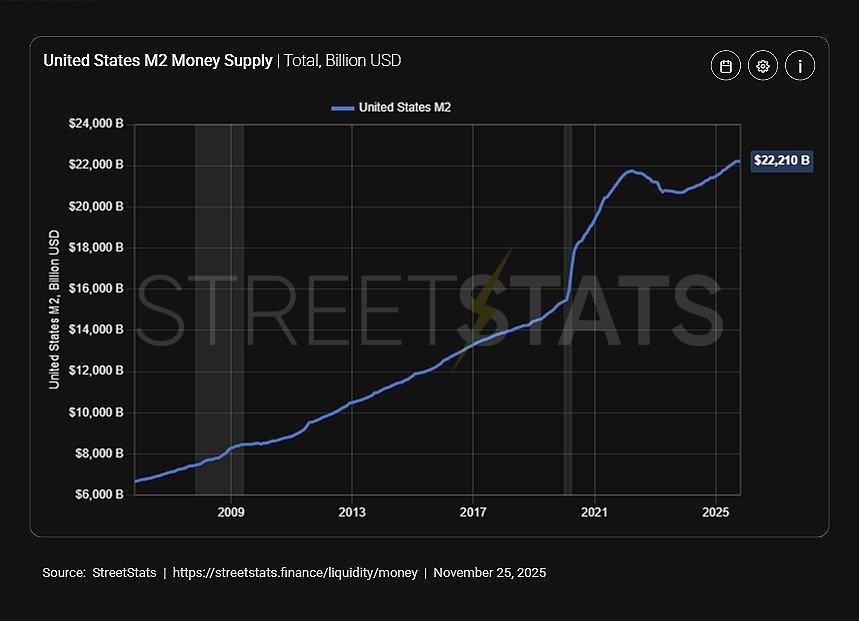

The money supply in the United States was around 3 trillion dollars in 1990. Today it is over 21 trillion dollars. Every major economic chart tells the same story. More printing, dilution & Inflation of the value of every currency on earth.

With this trend continuing globally, it becomes clear why Bitcoin will not stay low forever. You cannot keep inflating money and expect people to hold assets that lose purchasing power year after year.

Inequality and Control Explain Why Bitcoin Will Not Stay Low Forever

Now ask yourself this. Do you think inequality will magically shrink?

The top 1 percent owns more than 30 percent of global wealth. The gap grows every year. Nothing in current policy suggests this trend will reverse. People want fairness. They want transparency. They want control of their savings.

Then comes the bigger question. Do you believe politicians will stop fighting for power? History has shown the opposite. Every crisis becomes a tool to increase authority.

And this is exactly why people eventually search for systems that cannot be controlled or manipulated. This is another reason why Bitcoin will not stay low forever.

Surveillance and Debt Push More People Toward Bitcoin

Do you think governments and corporations will reduce surveillance?

Every phone, every search, every card swipe is tracked. Privacy is not improving.

People do not even realise how much of their daily life is being collected and analysed.

On top of that, the United States has crossed 38 trillion dollars in national debt. And debt does not shrink. It expands. Every new crisis forces more borrowing.

It is impossible to look at these trends and not understand why Bitcoin will not stay low forever. People eventually move toward assets that cannot be inflated, seized, censored or frozen.

Bitcoin Becomes the Natural Answer

For most people, Bitcoin still feels new and confusing. It challenges everything we grew up accepting. But once you begin asking the right questions about money, inflation, inequality and debt, Bitcoin naturally appears as the answer.

Not as a quick profit.

Not as an overnight investment.

But as an alternative system.

A different way to store value.

A different way to protect your future.

This is what millions of people are slowly realising. This is why global adoption is rising every year. And this is why Bitcoin will not stay low forever.

If you want to understand this deeper, you can learn everything step by step through the Bitcoin Essential Course by Azad Money which explains money, inflation and Bitcoin in simple language.

Money Education Changes Everything

Most people live paycheck to paycheck. They focus on basic needs and do not have time to study new monetary systems. That is completely understandable. But the gap is closing now.

The more people learn, the more they discover that Bitcoin is not here to replace their life. It is here to give them a choice. A choice they never had under the fiat system.

If you want to explore data and long term price cycles, check out StreetStats for a clear picture of what long term holders already understand.

Because somewhere between studying money, inflation and debt, you see why Bitcoin will not stay low forever.

And that is where the real journey begins.

Study The Bitcoin Standard. Then tell me honestly if you can find a better form of money. I will wait.